Wednesday Market Update – Eastside Residential Market Stats as of 9/7/22:

RECAP:

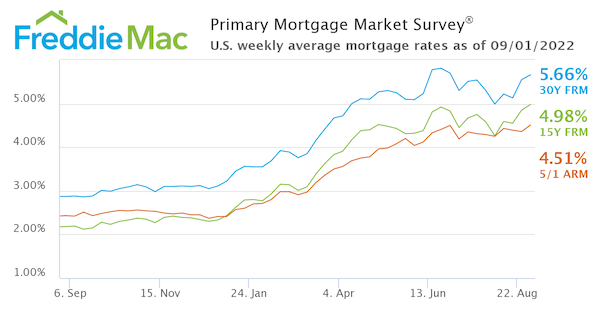

Active listings continue their decline this week. Pending sales showed a minor increase, which tightened the Months of Inventory. Normally, we would not expect the dynamics of the market to improve over a holiday weekend, but the rise again of interest rates likely pushed some buyers forward due to the fear of further rate increases.

THE NUMBERS:

Active Listings reached their highest level this year on 7/27/22 at 1189. Active Listings are down from last week. 991 vs 1061 a 7% decrease. Compared to a year ago this week, listings are up 329%.

Active List Prices peaked this year in the week of 3/9/22 with the median at $2,499,500. As of this week they are at a median price of $1,695,000.

Pending Sales are up from last week. 125 vs 114 a 2% increase. Compared to a year ago this week, pending sales are down 6%.

Pending Sales Prices peaked this year in the week of 3/30/22 with the median at $1,659,500. As of this week, they are now at a median of $1,399,950, which is up from last week where they were at $1,382,500.

Months of Inventory reached their lowest level (favoring a seller) this year in the week of 3/9/22 at 0.16 months of inventory and reached there highest level (favoring a buyer) in the week of 7/27/22 at 2.47 months of inventory

Current Months of Inventory dropped this week. It was 2.15 months of inventory last week and is now 1.83 months of inventory.

(Months of Inventory Guide: 2 months or less = Seller Favored, 2-4 months = Balanced Market, 4+ months = Buyer Favored)

Rate Chart:

As always… If we can help with any questions as you contemplate your real estate moves, let us know! Tony Meier & Team – Windermere