Click the images below to download your free copy!

5 Reasons to Sell Your House This Spring

When selling a house, most homeowners hope for a quick and profitable transaction that puts them in a position to make a great move. If you’re waiting for the best time to win as a seller, the market is calling your name this spring. Here are five reasons why this is the perfect time to sell your house if you’re ready.

1. There’s high demand from homebuyers.

Buyer demand is strong right now, and buyers are active in the market. ShowingTime, which tracks the average number of buyer showings on residential properties, recently announced that buyer showings are up 51.5% compared to this time last year. Daniil Cherkasskiy, Chief Analytics Officer at ShowingTime, notes:

“As anticipated, demand for real estate remains elevated and continues to be affected by low levels of inventory…On average, each home is getting 50 percent or more requests this year compared to January of last year. As we head into the busy season, it’s likely we’ll push into even more extreme territory until the supply starts catching up with demand.”

When your house is positioned to get a ton of attention from competitive buyers, you’re in the best spot possible as the seller.

2. There aren’t enough houses for sale.

Purchaser demand is so high, the market is running out of available houses for sale. Recently, realtor.com reported:

“Nationally, the inventory of homes for sale in February decreased by 48.6% over the past year, a higher rate of decline compared to the 42.6% drop in January. This amounted to 496,000 fewer homes for sale compared to February of last year.”

The National Association of Realtors (NAR) also reveals that, while home sales are skyrocketing, the inventory of existing homes for sale is continuing to drop dramatically. Houses are essentially selling as fast as they’re hitting the market – in fact, NAR reports that the average house is on the market for only 21 days.

It’s this imbalance between high buyer demand and a low supply of houses for sale that gives sellers such an advantage. A seller will always negotiate the best deal when demand is high and supply is low. That’s exactly what’s happening in the real estate market today.

3. You have a lot of leverage in today’s market.

Clearly, many more people are interested in buying than selling this spring, creating the ultimate sellers’ market. When this happens, homeowners in a position to sell have the upper hand in negotiations.

According to NAR, agents are reporting an average of 3.7 offers per house and an increase in bidding wars. As a seller, this means the ball is in your court – so much so that you can use your leverage to negotiate the best possible contract. Demand is there, and now is the perfect time to sell for the most favorable terms.

4. It’s a great way to use your home equity.

According to the latest data from CoreLogic, as of the third quarter of 2020, the average homeowner gained $17,000 in equity over the past year, and that number continues to grow as home values appreciate. Equity is a type of forced savings that grows during your time as a homeowner and can be put toward bigger goals like buying your next dream home.

Mark Fleming, Chief Economist at First American, notes:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity. In today’s housing market, fast rising demand against the limited supply of homes for sale has resulted in continued house price appreciation.”

5. It’s a chance to find a home that meets your needs.

So much has changed over the past year, including what many of us need in a home. Spending extra time where we currently live is enabling many of us to re-evaluate homeownership and what we find most important in a home.

Whether it’s a house that has the features suited to working remotely, space for virtual or hybrid schooling, a home gym or theater, or something else, selling this spring gives you a chance to make a move and find the home of your dreams.

Bottom Line

Today’s housing market belongs to the sellers. If you’ve considered making a move but have been waiting for the right market conditions, your wait may be over. Let’s connect so you’ll be positioned to win when you sell your house this spring.

NWMLS March 2021 Real Estate Market Report – Housing market stays hot despite some “lousy” February weather

KIRKLAND, Washington (March 4, 2021) – Housing activity during February remained hot around much of Washington state despite significant accumulation of lowland snow over the Valentine’s Day weekend, according to latest statistical report from the Northwest Multiple Listing Service.

“It’s amazing how close the February numbers are when compared to February 2020, which was, of course, right before our world changed,” said Mike Grady, president and CEO of Coldwell Banker Bain.” Despite our similarly lousy February weather, the data show that the market continues to be hot, with residential inventory very tight and median prices rising by double digits across most of our counties.”

Northwest MLS figures show brokers added a similar number of new listings of single family homes and condos last month (7,418) as a year ago (7,786), for a difference of 368 properties (down 4.7%). For residential units (excluding condos), there was a 6.8% year-over-year (YOY) drop.

Total active listings of single family homes declined nearly 44% from a year ago. The selection of single family homes fell more than 51% while condo inventory rose 7.9%.

“A decline in listing volume this year should not surprise anyone,” remarked James Young, director of the Washington Center for Real Estate Research at the University of Washington.

“We are virtually sold out of unsold inventory everywhere in the Central Puget Sound area except the Seattle city core,” stated J. Lennox Scott, chairman and CEO of John L. Scott Real Estate.

There are only about three weeks of supply (0.74 months) of inventory in the MLS database, which covers 26 counties. For residential only (excluding condos), the shortage is more pronounced at only 0.67 months’ supply.

Condominium shoppers will find somewhat more selection, with inventory up 7.93% from a year ago, and more than a month of supply (1.12 months).

“While pending condominium sales were down slightly in King County (-0.56%), it’s worth noting that several urban neighborhoods, including Queen Anne, Downtown Seattle, and Ballard performed better than expected. That suggests to me that there may not be the mass exodus from the core urban areas that many have been predicting,” commented Windermere Chief Economist Matthew Gardner.

Nearly six of every 10 pending sales of condos took place in King County last month, according to the Northwest MLS report. Pending activity nearly match the year ago totals for that county (716 versus 720). Pending sales (mutually accepted offers) were up sharply in several Seattle neighborhoods, including Queen Anne (48.8%), West Seattle (42.1%), and Ballard/Green Lake (32.5%). Even the Downtown/Belltown area registered an uptick (4.8%).

Gardner said it was particularly interesting to see the jump in pending sales in the Puget Sound region from January and February. For the tri-county area encompassing King, Pierce and Snohomish counties, the MLS report shows there were 4,896 pending sales in January and 5,232 sales in February for a month-to-month gain of 6.9%.

“This tells me that neither the snowstorm that hit the region nor the jump in mortgage rates deterred buyers who were still out in force last month,” said Gardner.

Lennox Scott also noted the slight increase in mortgage rates, saying it “created a mini power surge of sales activity intensity.”

Freddie Mac reported an average rate of 3.02% for a 30-year fixed-rate mortgage for the week ending March 4. That’s up five basis points from the previous week, and the first time since July 2020 that the benchmark mortgage rate climbed above 3%.

Despite rates edging up and inclement weather during much of February, eight counties in the Northwest MLS report showed year-over-year gains in pending sales: Adams, Douglas, Grant, Kitsap, Lewis, Pacific, San Juan, and Walla Walla.

System-wide, there were 7,724 pending sales in February, a YOY drop of 7.5%, but compared to January when brokers reported 7,394 sales, the pending volume increased 4.5%.

Within King County, Gardner noted suburban markets such as Renton, Burien, “and interestingly, West Seattle (given the bridge issue),” continued to see significant sales activity in February, “but so too did more urban markets like Madison Park/Capitol Hill, Ballard/Green Lake, Queen Anne, and Magnolia, all of which reported sizable increases in home sales.”

Of the 30 neighborhood areas the MLS tracks within King County, thirteen of them showed year-over-year increases in pending sales.

Northwest MLS director John Deely, executive vice president of operations at Coldwell Banker Bain, said, “Like last year, before we knew what was just around the corner, buyer demand is high. There continues to be opportunities for buyers seeking condos, and median prices are more stable, so that’s also good news for buyers.”

On the residential side (excluding condos), Deely said he is hearing more and more about multiple offer situations. “Our brokers are working hard to help prepare buyers both emotionally and financially for the realities they face, and to help position them as the winning purchaser. With things opening up, and open house restrictions eased to allow more people at one time, brokers are also spending a good amount of time preparing their sellers to get comfortable with having people in their homes and to safely facilitate viewings, as well as managing and analyzing all the offers.”

Northwest MLS member-brokers reported 5,812 closed sales during February for a 10.4% increase over the year-ago total of 5,265 closings. The median price on last month’s completed sales jumped more than 15% from a year ago, increasing from $445,000 to $512,000. Twenty of the 26 counties in the report showed double-digit YOY price gains.

“Continuing low interest rates, jobs, and lifestyle changes are driving the real estate market,” said Dean Rebhuhn, owner of Village Homes and Properties, who also noted the uptick in multiple offers. “Prepared, aggressive buyers are winning the competition for homes. Smart buyers are making substantial offers to sellers prior to the offer review date, and sellers are considering them.”

Scott noted March historically marks the beginning of an eight-month primetime real estate market. “After an intense winter in the local real estate market, more new resale listings are on the horizon,” he remarked, adding, “The intensity we’re seeing should come down slightly as more available homes enter the market, but we have to play catch-up with pent-up buyer demand first.”

Grady expressed similar views. “The positive, optimistic mood is unmistakable, and we expect that to continue as vaccines roll out, things continue opening, and projects like the Northgate Link Light Rail station are completed, allowing people to move further out as they can more efficiently manage their commutes. We are bullish on the market this spring, and frankly, for the rest of the year. Bring on the Roaring ‘20s, version 2.0,” he exclaimed.”

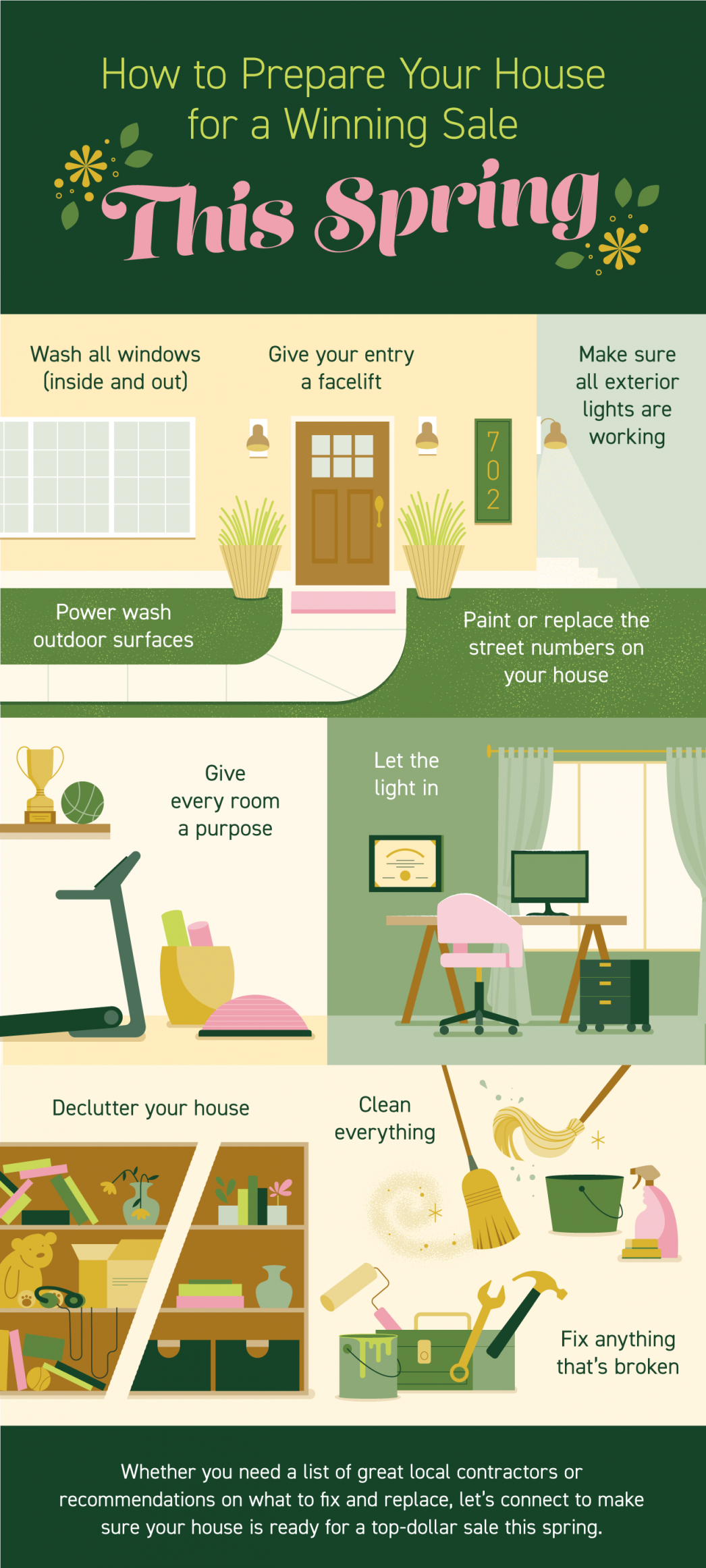

How to Prepare Your House for a Winning Sale This Spring [INFOGRAPHIC]

Is It a Good Time to Sell My House?

Last year, many homeowners thought twice about selling their houses due to the onset of the health crisis. This year, however, homeowners are beginning to regain their confidence when it comes to selling safely. The latest Home Purchase Sentiment Index (HPSI) by Fannie Mae shows that 57% of consumers believe now is a good time to sell.

Doug Duncan, Vice President and Chief Economist at Fannie Mae, explains:

“Overall, the index’s monthly increase was driven largely by a substantial jump in the share of consumers reporting that it’s a good time to sell a home, with many citing favorable mortgage rates, high home prices, and low housing inventory as their primary rationale.”

Normally, spring is the busiest season in the housing market – the time when many homeowners decide to list their houses. While this is obviously not a normal year since the pandemic is still very much upon us, experts are optimistic that consumer positivity around selling will lead to more homeowners making moves this year. Duncan continues to say:

“We will pay close attention to see if this newfound optimism develops into a trend.”

What does this mean if you’re thinking of selling your house?

The fact that there are so few houses available for sale today is one driver that’s encouraging consumers to think more positively about selling. The National Association of Realtors (NAR) states:

“Total housing inventory at the end of January amounted to 1.04 million units, down 1.9% from December and down 25.7% from one year ago (1.40 million).”

With so few homes available to buy, your house will be more likely to rise to the top of an eager purchaser’s wish list in this competitive market. Today’s high buyer activity is creating upward pressure on home prices and more multiple-offer scenarios. According to the Realtors Confidence Index Survey from NAR, the average home for sale is receiving 3.7 offers today, up from 2.3 offers just one year ago. This makes selling even more enticing.

In this kind of sellers’ market, you have a huge advantage in the process. And here’s another win – you can also use your equity toward a down payment on a new home when you move.

Wondering where you’ll go if you try to move while it’s so challenging to find a home to buy? Well, in many areas, there are more homes available at the higher end of the market, so finding a move-up home may be less of an issue if you’re ready to search for your dream home this spring.

Bottom Line

If you pressed pause on selling your house last year, now may be the best time to put your plans back into motion while inventory is so low. Let’s connect today to get the process started.

Sold 29% Above List Price with 15 Offers! Beautiful Remodeled 4 Bedroom, 2.5 Bath Home + Den in Coventry on English Hill

Listed at $975,000

Click Here For Full Details

Beautifully updated two story in Coventry on English Hill. The light filled 2,400 s.f. floorplan features 4 bedrooms, 2.5 baths plus den on a serene 8,368 s.f. lot. Recent updates include: new carpet, interior paint, updated kitchen and brand new bathrooms.

The open entry welcomes you in with hardwood floors and spacious coat closet. Sunken formal living room with lovely bay windows overlooking the lush front yard. Formal dining room is spacious with elegant light fixture. Remodeled kitchen with granite counters, under mount sink, ample custom maple cabinetry, breakfast bar with seating, five burner gas range and stainless steel appliances included. Spacious nook with bay windows overlooking the backyard. Built-in desk with plenty of cabinet storage. Relaxing family room features gas fireplace with tile surround and mantel, built-ins and sliding door to the rear patio. Den with built-in cabinets – perfect for working at home. Remodeled powder room for your guests. Laundry room with cabinets and soaking sink – washer and dryer included!

Gracious master suite features bay windows and walk-in closet. Remodeled spa-like master bath includes double vanity with quartz counters, heated floors, oversized shower with rain shower head and large soaking tub. Three additional spacious bedrooms. Remodeled full hall bath with skylight, brand new vanity with quartz counter, new tile shower surround, all new fixtures and luxury vinyl plank floors.

Well maintained fully fenced rear yard is ideal for entertaining and relaxing. Gardeners will delight in the ample bed space. The home is part of the English Hill HOA which has acres of open space, walking trails & a basketball court for your enjoyment.

Outstanding Northshore schools – Sunrise Elementary, Timbercrest Jr High & Woodinville High.

How Smart Is It to Buy a Home Today?

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move.

However, there’s one category that provides a simple answer. When deciding to buy now or wait until next year, the financial aspect of the purchase is easy to evaluate. You just need to ask yourself two questions:

- Do I think home values will be higher a year from now?

- Do I think mortgage rates will be higher a year from now?

From a purely financial standpoint, if the answer is ‘yes’ to either question, you should strongly consider buying now. If the answer to both questions is ‘yes,’ you should definitely buy now.

Nobody can guarantee what home values or mortgage rates will be by the end of this year. The experts, however, seem certain the answer to both questions above is a resounding ‘yes.’ Mortgage rates are expected to rise and home values are expected to appreciate rather nicely.

What does this mean to you?

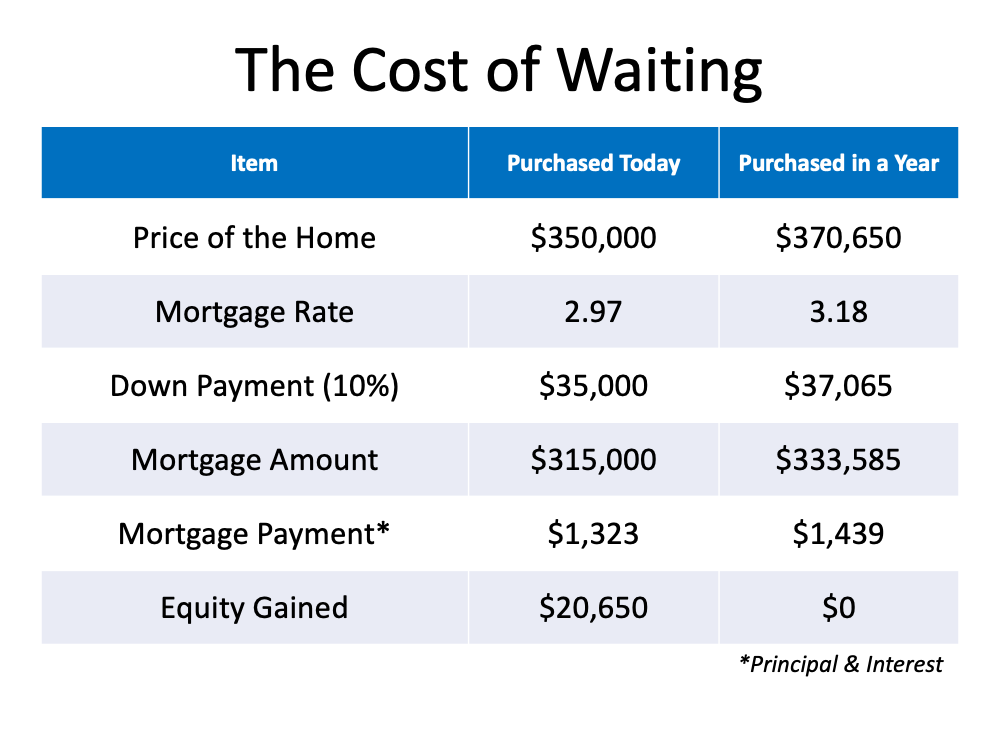

Let’s look at how waiting would impact your financial situation. Here are the assumptions made for this example:

- The experts are right – mortgage rates will be 3.18% at the end of the year

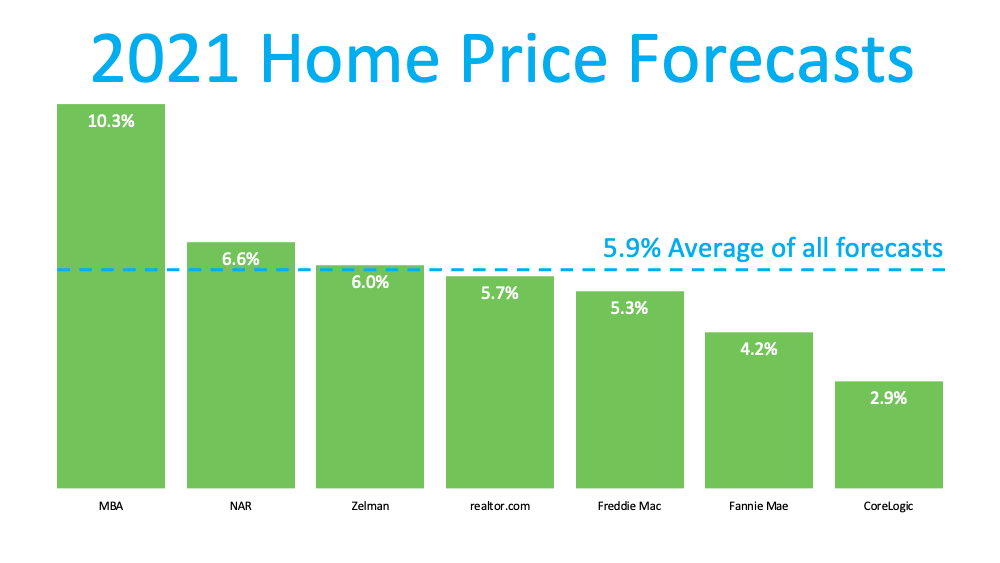

- The experts are right – home values will appreciate by 5.9%

- You want to buy a home valued at $350,000 today

- You decide on a 10% down payment

Here’s the financial impact of waiting:

Here’s the financial impact of waiting:

- You pay an extra $20,650 for the house

- You need an additional $2,065 for a down payment

- You pay an extra $116/month in your mortgage payment ($1,392 additional per year)

- You don’t gain the $20,650 increase in wealth through equity build-up

Bottom Line

There are many things to consider when buying a home. However, from a purely financial aspect, if you find a home that meets your needs, buying now makes much more sense than buying next year.

Sold 11% Over List Price! Traditional 4 Bedroom Home With Office & Bonus Room on a Large Park-like Lot in Aspenwood a Desirable Woodinville Neighborhood

Listed at $1,190,000

Click Here For Full Details

Traditional two story located in Aspenwood, a desirable Woodinville neighborhood. The light filled 3,440 s.f. floorplan features 4 bedrooms, 2.75 baths, den and bonus room on a lush, flat 38,044 s.f. lot. Special features include: Updated kitchen, refinished hardwood floors, new carpets, new exterior/interior paint and built in vacuum.

Spacious entry with open staircase and hardwood floors. Formal living room surrounded with natural light, soaring ceiling, white millwork, wainscoting, and gas fireplace with white mantel. Formal dining room with French doors leading to the sunroom, wainscoting, white millwork and decorative ceiling. Updated kitchen with white cabinets, granite counter, undermounted sink with windows overlooking the yard and skylight – all stainless steel appliances included! Spacious nook with large window showcasing the yard. Relaxing family room featuring soaring ceiling, gas fireplace with brick surround and built-in cabinets. Main-floor bedroom with adjacent three-quarter bath – great for guests or in-law suite. Huge laundry room with storage closet, soaking sink, ample cabinets and counter space – washer and dryer included!

Inviting master suite featuring a wall of windows and walk-in closet. Master bath with double vanity, jetted tub and shower. Two additional spacious bedrooms upstairs. Home office with built in desk and shelving – perfect for working from home. Well maintained full bath with double vanity, tub and shower surround. Large bonus room with ample windows – great for game room, home theater, play room – many possibilities!

Expansive deck features jetted hot tub and open spaces to bbq – great for entertaining. Well manicured, park-like yard with David Austin roses. Various fruit trees include cherry, apple, plum and blueberry bushes. Plenty of garden space with existing garden beds plus storage shed with light and power. Attached 3-car garage with loft storage areas and workshop area.

Outstanding Northshore schools – Eastridge Elementary, Timbercrest Middle School & Woodinville High School.

Home Prices: What Happened in 2020? What Will Happen This Year?

The real estate market was on fire during the second half of 2020. Buyer demand was way up, and the supply of homes available for sale hit record lows. The price of anything is determined by the supply and demand ratio, so home prices skyrocketed last year. Dr. Lynn Fisher, Deputy Director of the Federal Housing Finance Agency (FHFA) Division of Research and Statistics, explains:

“House prices nationwide recorded the largest annual and quarterly increase in the history of the FHFA Home Price Index. Low mortgage rates, pent up demand from homebuyers, and a limited housing supply propelled every region of the country to experience faster growth in 2020 compared to a year ago despite the pandemic.”

Here are the year-end home price appreciation numbers from the FHFA and two other prominent pricing indexes:

- Federal Housing Finance Agency House Price Index Report: 10.8%

- CoreLogic Home Price Insights: 9.2%

- S&P Case-Shiller U.S. National Home Price Index: 10.4%

The past year was truly a remarkable time for homeowners as prices appreciated substantially. Lawrence Yun, Senior Economist at the National Association of Realtors (NAR), reveals:

“A typical homeowner in 2020, just by being a homeowner, would have accumulated around $24,000 in housing wealth.”

What will happen with home prices this year?

Many experts believe buyer demand will soften somewhat as mortgage rates are poised to bump up slightly. Some also believe the inventory challenge will ease as more listings come to market this year.

Based on this, most forecasters anticipate we’ll see strong appreciation in 2021 – but not as strong as last year. Here are seven prominent groups and their projections:

Bottom Line

Home price appreciation will be strong this year, but it won’t reach the historic levels of 2020. Let’s connect if you’d like to find out what your house is currently worth in our local market.

What Are the Benefits of a 20% Down Payment?

If you’re thinking of buying a home this year, you may be wondering how much money you need to come up with for your down payment. Many people may think it’s 20% of the loan to secure a mortgage. While there are plenty of lower down payment options available for qualified buyers who don’t want to put 20% down, it’s important to understand how a larger down payment can have great benefits too.

The truth is, there are many programs available that allow you to put down as little as 3.5%, which can be a huge benefit to those who want to purchase a home sooner rather than later. Those who have served our country may also qualify for a Veterans Affairs Home Loan (VA) and may not need a down payment. These programs have really cut down the savings time for many potential buyers, enabling them to start building family wealth sooner.

Here are four reasons why putting 20% down is a good plan if you can afford it.

1. Your interest rate may be lower.

A 20% down payment vs. a 3-5% down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage interest rate they’ll likely be willing to give you.

2. You’ll end up paying less for your home.

The larger your down payment, the smaller your loan amount will be for your mortgage. If you’re able to pay 20% of the cost of your new home at the start of the transaction, you’ll only pay interest on the remaining 80%. If you put down 5%, the additional 15% will be added to your loan and will accrue interest over time. This will end up costing you more over the lifetime of your home loan.

3. Your offer will stand out in a competitive market.

In a market where many buyers are competing for the same home, sellers like to see offers come in with 20% or larger down payments. The seller gains the same confidence as the lender in this scenario. You are seen as a stronger buyer with financing that’s more likely to be approved. Therefore, the deal will be more likely to go through.

4. You won’t have to pay Private Mortgage Insurance (PMI)

What is PMI? According to Freddie Mac:

“PMI is an insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%. Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As mentioned earlier, when you put down less than 20% when buying a home, your lender will see your loan as having more risk. PMI helps them recover their investment in you if you’re unable to pay your loan. This insurance isn’t required if you’re able to put down 20% or more.

Many times, home sellers looking to move up to a larger or more expensive home are able to take the equity they earn from the sale of their house to put down 20% on their next home. With the equity homeowners have today, it creates a great opportunity to put those savings toward a 20% or greater down payment on a new home.

If you’re looking to buy your first home, you’ll want to consider the benefits of 20% down versus a smaller down payment option.

Bottom Line

If you’re thinking of buying a home and are already saving for your down payment, let’s connect to discuss what fits best with your long-term plans.