NWMLS May 2019 Real Estate Market Report – Home Buyers Are “Better Off,” But Market is Heating Up

KIRKLAND, Washington (June 6, 2019) – The housing market in western Washington may not be as hot as it was last spring, but it is heating up, suggested one industry leader in commenting on the latest statistics from Northwest Multiple Listing Service.

Matt Deasy, president of Windermere Real Estate/East, Inc. said his analysis of single family home sales in King County reveals 7 out of 10 properties that sold during May had 15 or fewer days on the market. He also noted more than half the listings (55 percent) in the county sold for at or above list price, the highest ratio since July 2018.

Northwest MLS figures show last month’s 12,006 pending sales across its 23 county service area nearly matched the year-ago total of 12,168 mutually accepted offers. Nine counties notched increases.

Two other indicators of activity – the volume of new listings, and the number of closed sales – both showed slight gains from a year ago. MLS member brokers added 14,689 new listings to inventory during May, up 165 units from twelve months ago. Year-over-year (YOY) closed sales rose about 1.6 percent (from 9,011 in May 2018 to last month’s total of 9,153).

Several representatives of Northwest Multiple Listing Service commented on increasing activity:

“The housing market definitely got busier in May with brokers reporting an uptick in showings, open house traffic, and offers.”- OB Jacobi, Windermere Real Estate Co.

“We are swinging into our summer market at a little faster clip than last year, and have a few more houses for buyers to choose from.”- Frank Wilson, John L. Scott, Inc.

“The spring real estate market remains very good for both buyers and sellers.”- Dean Rebhuhn, Village Homes and Properties.

“Buyers rejoiced at lower interest rates in May.”- J. Lennox Scott, John L. Scott, Inc.

In addition to favorable financing, Scott said, “Increased inventory and continued job growth built on April’s momentum, translating to strong results in May.” While inventory has increased in many areas, Scott noted there are still severe shortages of listings in some price ranges.

Inventory improved 24.5 percent from a year ago, with brokers adding 14,689 new listings to outpace the 12,006 pending sales. The MLS report for May shows 16,133 active listings at month end, up from the year-ago total of 12,956. King County recorded the largest gain in total inventory, at more than 62 percent, but supply remained below 2 months in that and several other counties.

System-wide there was 1.76 months of supply at the end of May, well below the 4-to-6 months that experts say indicate a balanced market. “While our inventory has grown a little, we’re still well within the definition of a seller’s market,” said Frank Wilson, a broker in Kitsap County where there is only 1.46 months of supply.

An analysis of Northwest MLS inventory at the end of May underscores Scott’s point. It shows only 13.8 percent of the listings of single family homes have asking prices under $600,000. That compares to 25.6 percent in Snohomish County, 31.2 percent in Pierce County and 35.3 percent in Kitsap County.

Comparing May’s prices by housing types and geographic areas shows wide variation. Prices for single family homes (up 5.2 percent) outperformed condos (up nearly 1.4 percent). System-wide, sales of single family homes and condos that closed during May increased nearly 4.8 percent YOY, and rose more than 3.5 percent from April. A county-by-county comparison shows price changes ranged from a year-over-year drop of more than 20 percent (in Okanogan County) to a jump of more than 52 percent (in Pacific County).

Single family homes:

Home prices for single family homes (excluding condominiums) are up 5.2 percent system-wide, rising from the year ago figure of $429,500 to last month’s figure of $451,800.

King County prices for single family homes show a 3.6 percent decline from a year ago, but are at the highest level since June when the median price was $715,000. Snohomish nearly matched last June’s figure of $510,000, the highest for the year. A review of figures for the past five years shows both Kitsap and Pierce counties reached new highs (at $385,000 and $370,000, respectively) for last month’s median prices for sales of single family homes.

Three other counties (in addition to King) reported year-over-year drops in median prices on single family homes, led by Okanogan County where selling prices plunged more than 20 percent. Also reporting declines were San Juan County (-0.51 percent) and Snohomish County (-0.01 percent).

Condos:

Condo prices also rose, but at a smaller rate, as inventory continued to build (up nearly 65 percent). Area-wide prices increased about 1.4 percent from a year ago. Pierce County prices surged 18 percent, while condo prices in King County were mostly flat (up 0.7 percent). Only six counties reported year-over-year price declines.

Prices overall (single family homes and condominiums):

Prices overall, including single family homes and condos are up $20,000 (nearly 4.8 percent) from a year ago, increasing from $420,000 to $440,000. In King County, the median sales price was $645,000, down less than a percent (-0.77) from a year ago. Snohomish County also reported a fractional drop, declining from $478,615 to $476,025 (down 0.54 percent).

“Home prices in the Seattle metro area are still lower than they were a year ago, but only marginally,” remarked Jacobi, but added, “Thanks to the pretty significant drop in interest rates last month, we can expect to see home prices trending higher through the end of the year, but at a far more moderate pace than the last several years.”

Rebhuhn agreed, crediting lower interest rates, lower median prices, and new jobs as driving factors in South King County, Pierce County and Tacoma. “We look for a very active summer market,” he remarked.

James Young, director of the Washington Center for Real Estate Research at the University of Washington, also attributed strong activity along the I-5 corridor and outer urban centers to low interest rates. Also noteworthy, he suggested, was Douglas County where YOY prices surged more than 24 percent. “Cowlitz, Thurston, and Lewis counties continue to outperform,” he added.

Young said interest rates could drop further as 10-year yields continue to fall. “Given the search for value among those sellers trading down along with first-time buyers in all urban areas across the state, prices should continue to rise throughout the peak season,” he stated.

“The data for May extends the same phenomenon we’ve been part of for nearly five years,” said Mike Grady, president and COO of Coldwell Banker Bain. “Recall that just one year ago the headlines were asking, ‘Has the hot market ended?’ as inventory increased from 3-to-5 days to 1.8 months between May and August. Now, one year later, while we see many more listings are available, accepted offers are keeping pace and inventory remains relatively stable at 1.7-to-2 months.”

“A balanced market should have about a 6-month supply,” explained WCRER’s Young, noting the national month’s supply figure is at about 4 months. “Except for a few small counties, every county in the NWMLS area has a month’s supply of 4 or less. Except for Skagit County, with 2.2 months of supply, every county along the I-5 corridor has less than 2 months.”

Wilson, the Kitsap regional manager and branch managing broker at John L. Scott Real Estate in Poulsbo, emphasized “the numbers are all relative, relative to a ‘normal’ market which we are not in.” Noting the current inventory of 644 homes and condos is higher than last year when there were 519 active listings at this time, “it is half of what might be considered a balanced market here in Kitsap County.”

What people read about the Puget Sound market “is not reflective of our micro market” Wilson continued, noting one “huge difference” is the amount of vacant land that is available. “We have seen a bump in vacant land listings,” he reported, adding, “For those looking to build a home, there are a lot of opportunities in this area, though be prepared for a lengthy process to get a home plan approved and built here in Kitsap.”

“We’re in the midst of the four best months in the year for buyer activity,” Scott emphasized. “I recommend sellers ensure their home’s appearance, marketing strategy and broker associate relationship are all in tip-top shape,” he added.

Northwest Multiple Listing Service, owned by its member real estate firms, is the largest full-service MLS in the Northwest. Its membership of around 2,200 member offices includes more than 29,000 real estate professionals. The organization, based in Kirkland, Wash., currently serves 23 counties in the state.

JUST RELEASED! Our Summer 2019 Buyer and Seller Market Guides

Sold! Fantastic, Updated 2 Bedroom Condo in the Juanita Country Club Complex of Kirkland near Jaunita Beach

Sold for $355,000

Click Here for Details

Updated top floor condo in Juanita Country Club. The flowing floorplan boasts 938 s.f. and features 2 bedrooms and 2 full baths.

The living room features white millwork, vaulted ceiling, fireplace, sliding glass door to a private balcony and a cozy window seat. Dining room with sophisticated light fixture. Kitchen is fully remodeled and includes white cabinetry, quartz counters, double oven, pantry closet and laminate flooring – stainless steel appliances included.

Generous master bedroom with big closet and attached full bath. Master bath is updated and includes quartz counters and new fixtures. Additional guest bedroom adjacent to full bathroom. Laundry closet with LG front load washer/dryer included.

Private covered balcony with storage closet. Condo includes single car garage and ample visitor parking.

HOA dues are $421.50 and includes water, sewer, garbage, lawn service and common area maintenance. Property features a club house, athletic court, exercise room, hot tub, pool and sauna.

Outstanding Lake Washington schools – Bell Elementary, Finn Hill Middle School & Juanita High.

Sold! Great Entry Level Home! 3 Bedrooms, 2.25 Bathrooms, Fully Fenced, West-facing Yard in Olde Morrison Place on English Hill

Sold for $725,000

Click Here for Details

Great, entry level home in Olde Morrison Place on English Hill. The light filled 1,761 s.f. floorplan features 3 bedrooms, 2.25 baths on a serene, west-facing 12,032 s.f. lot! Updates include: Remodeled master bathroom, updated kitchen, fresh paint and AC!

Stunning, open entry with hardwood flooring, skylight and coat closet. Living and dining room with vaulted ceiling and ample windows overlooking the lush yard is a great open space to entertain. Kitchen with tile counters, breakfast bar, pantry closet, garden window and hardwood floors – seller credit of $2,500 towards new appliances! Nook with slider to back yard adjoins the kitchen and family room. Relaxing family room with gas fireplace, lovely built-ins and large window. Powder room on the main floor is great for your guests. Laundry room with soaking sink, ample cabinetry and counter space – washer and dryer included!

Spacious master suite features large window and walk-in closet. Remodeled master bath includes large vanity, quartz counters, oversized shower, skylight and tile floor. Two additional bedrooms with adjacent full bathroom and linen closet.

Serene, fully fenced, large yard with basketball court and storage shed. Attached two car garage with additional room for storage. Deep driveway with side gate access for possible RV parking.

Outstanding Northshore schools – Sunrise Elementary, Timbercrest Middle School & Woodinville High.

The Top Reasons to Own Your Home

Some Highlights:

- June is National Homeownership Month!

- Now is a great time to reflect on the many benefits of homeownership that go way beyond the financial.

- What reasons do you have to own your own home?

The Ultimate Truth about Housing Affordability

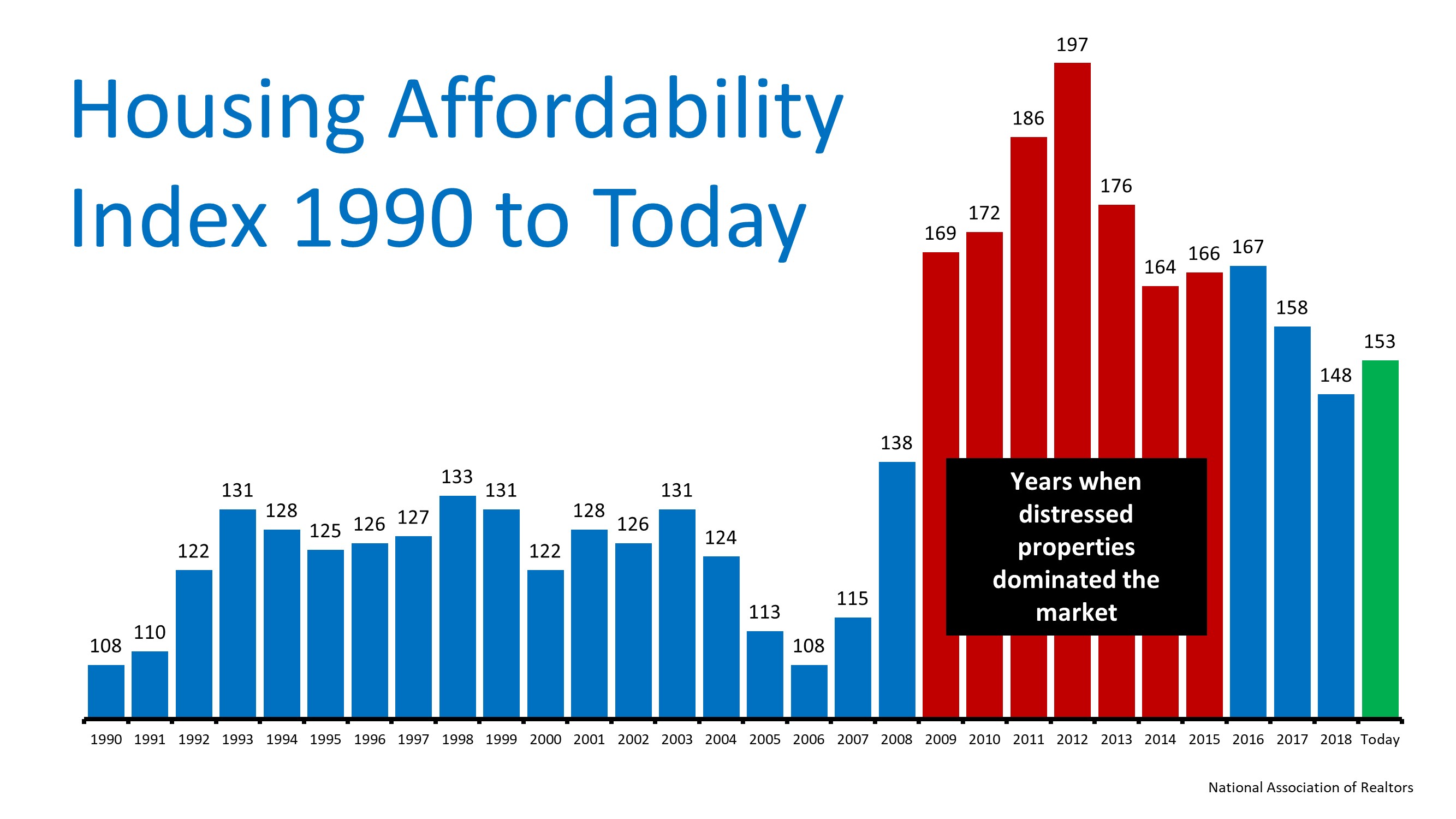

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Multigenerational Homes Are on the Rise

As loved ones start to get older, we start to wonder: how long will they be able to live alone? Will they need someone there to help them with daily life? There’s a reason to ask those questions now more than ever, as the average life expectancy in the U.S. is 78 years old! As a result, 41% of Americans in the market are searching for a home that can accommodate a multigenerational family.

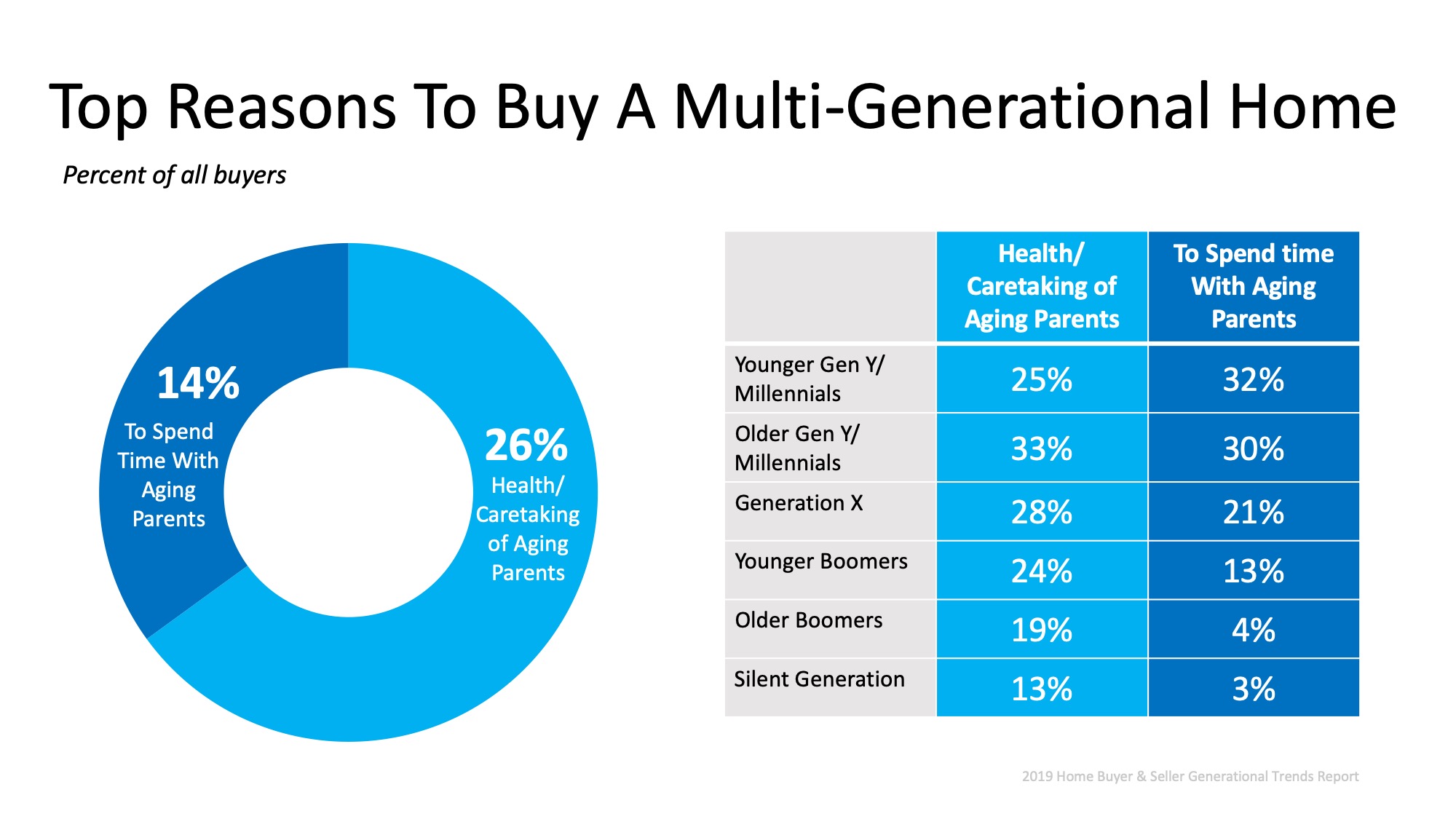

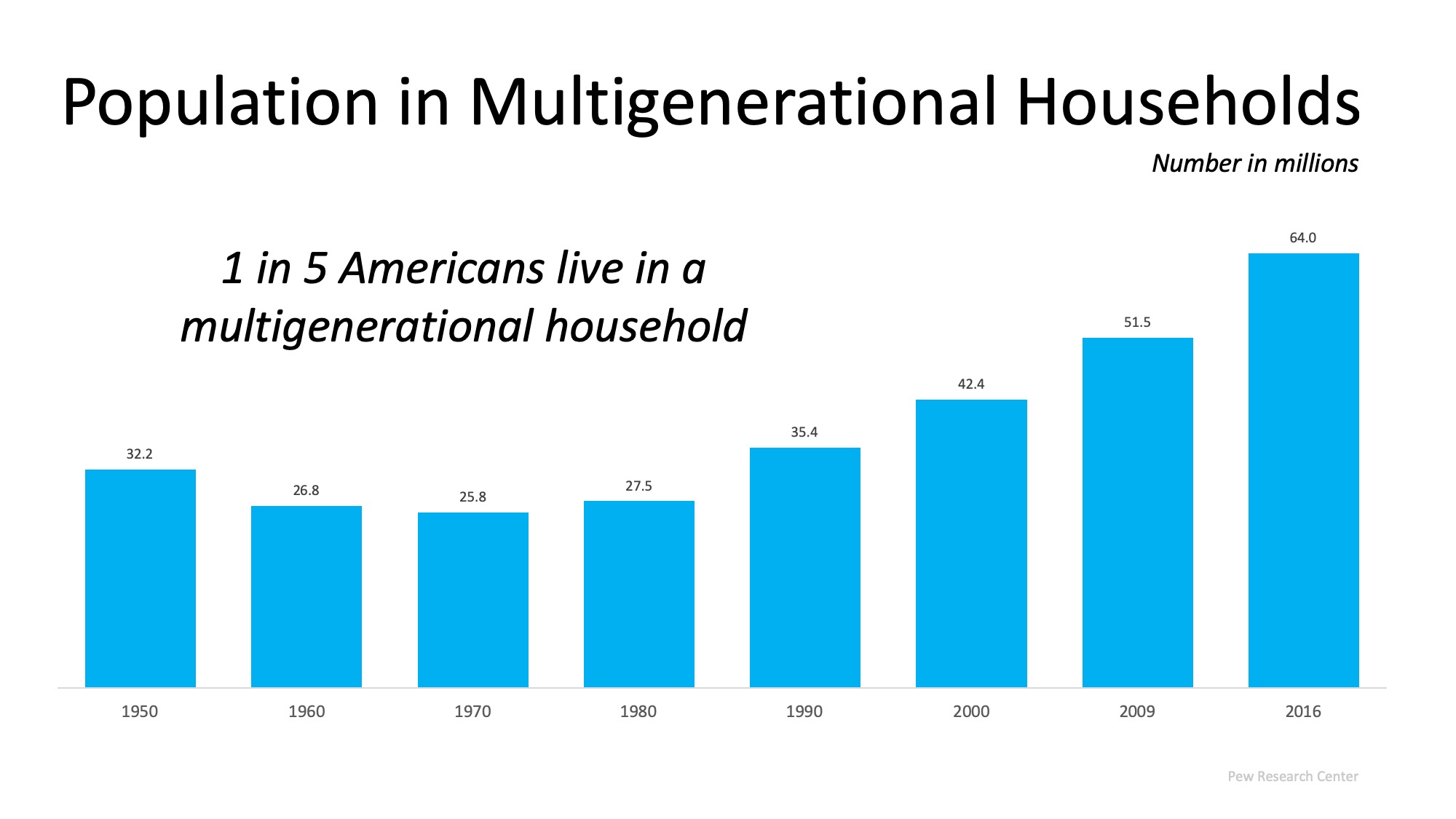

The graph below shows the number of people by generation that purchased a multigenerational home because they will either be taking care of an aging parent or they just want to spend time together. Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available).

Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available). An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

The University of Oxford

“Children who are close to their grandparents have fewer emotional and behavioral problems and are better able to cope with traumatic life events, like a divorce or bullying at school”.

Boston College

“Researchers found that emotionally close ties between grandparents and adult grandchildren reduced depressive symptoms in both groups”.

This research gives helpful insight into why 41% of Americans are in the market to buy a multigenerational home.

Bottom Line

If you have a home that could accommodate a multigenerational family and are thinking about selling, now is the perfect time to put it on the market! The number of buyers looking for this type of home will only continue to increase.

Sold! Lovely and Remodeled 3 Bedroom 2.5 Bathroom Home with Serene Yard backing to Greenbelt in Amberley on English Hill

Sold for $757,500

Click Here for Details

Completely remodeled home in Amberley on English Hill. The light filled 1,960 s.f. floorplan features 3 bedrooms, 2.5 baths on a serene 8,469 s.f. lot backing to the greenbelt! Updates include: Remodeled kitchen & bathrooms, white millwork, luxury vinyl plank flooring, fresh interior and exterior paint, new light fixtures, high-end ceiling fans, remodeled front deck, new garage doors and much more! Furnace and AC under two years old.

Stunning, open entry with luxury vinyl plank flooring and white millwork. Formal living room with expansive window overlooking the front yard, ceiling fan and white millwork. Formal dining room with bay window. Remodeled kitchen with ample cabinets, granite counters, breakfast bar, pantry closet and all stainless steel appliances included! Relaxing family room with gas fireplace, ceiling fan and slider to back deck. Remodeled powder room – great for your guests. Laundry room with soaking sink, cabinetry and storage closet – washer and dryer included!

The master suite is welcoming and spacious with ceiling fan, vaulted ceiling and walk-in closet. Remodeled master bath includes double vanity, quartz counters, oversized shower/soaking tub with two shower heads, skylight and tile floor. Two additional bedrooms, both featuring oversized closets and ceiling fans. Updated full hall bath features tile counter and tile floor.

Lovely, refinished deck leads down to large well manicured yard. Very private yard backs to green-belt, features new fence, lush plants and storage shed. Attached two car garage with additional room for storage.

The English Hill HOA has several acres of open space, walking trails & basketball court for your enjoyment.

Outstanding Northshore schools – Sunrise Elementary, Timbercrest Middle School & Woodinville High.

2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

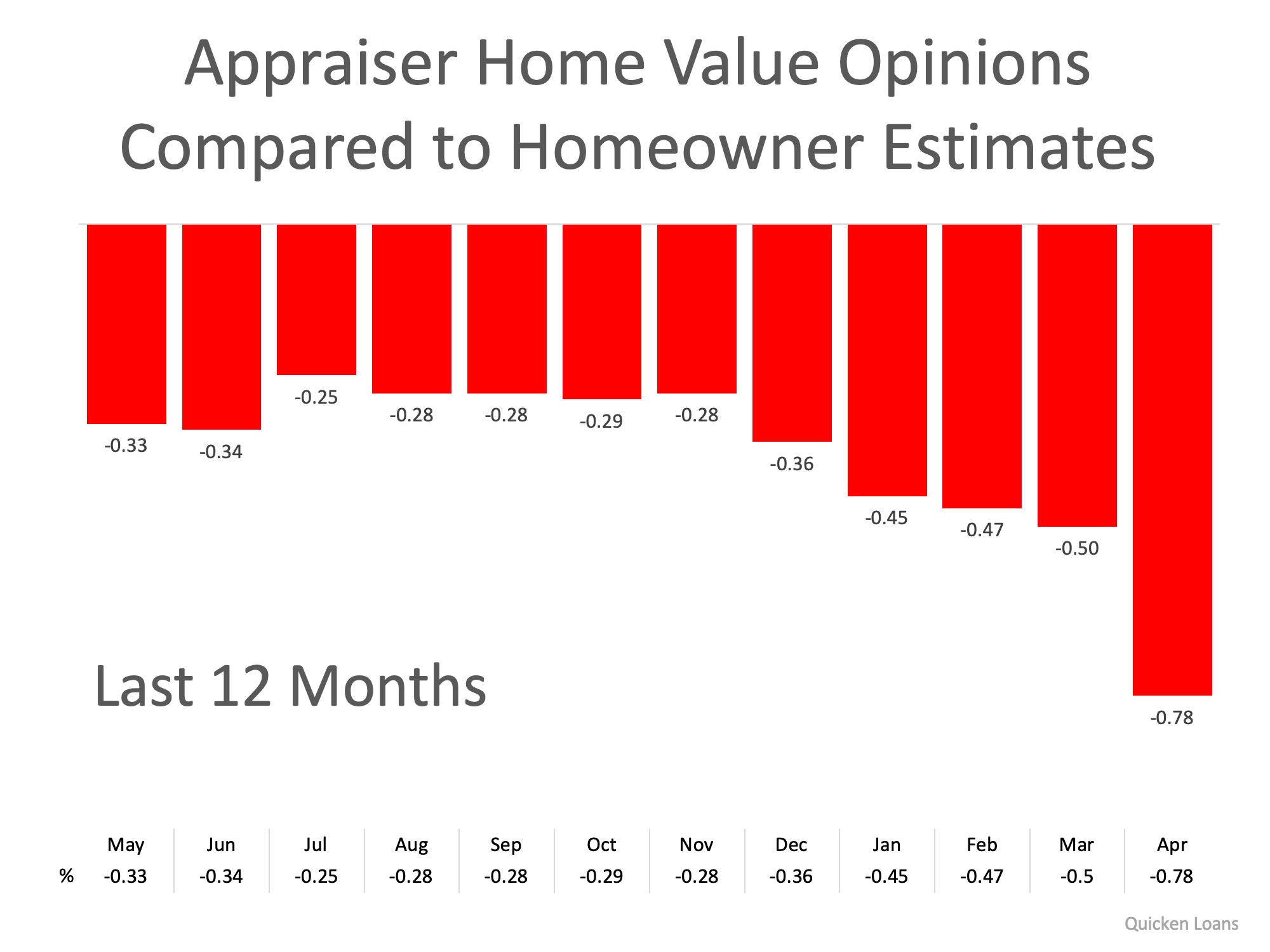

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!