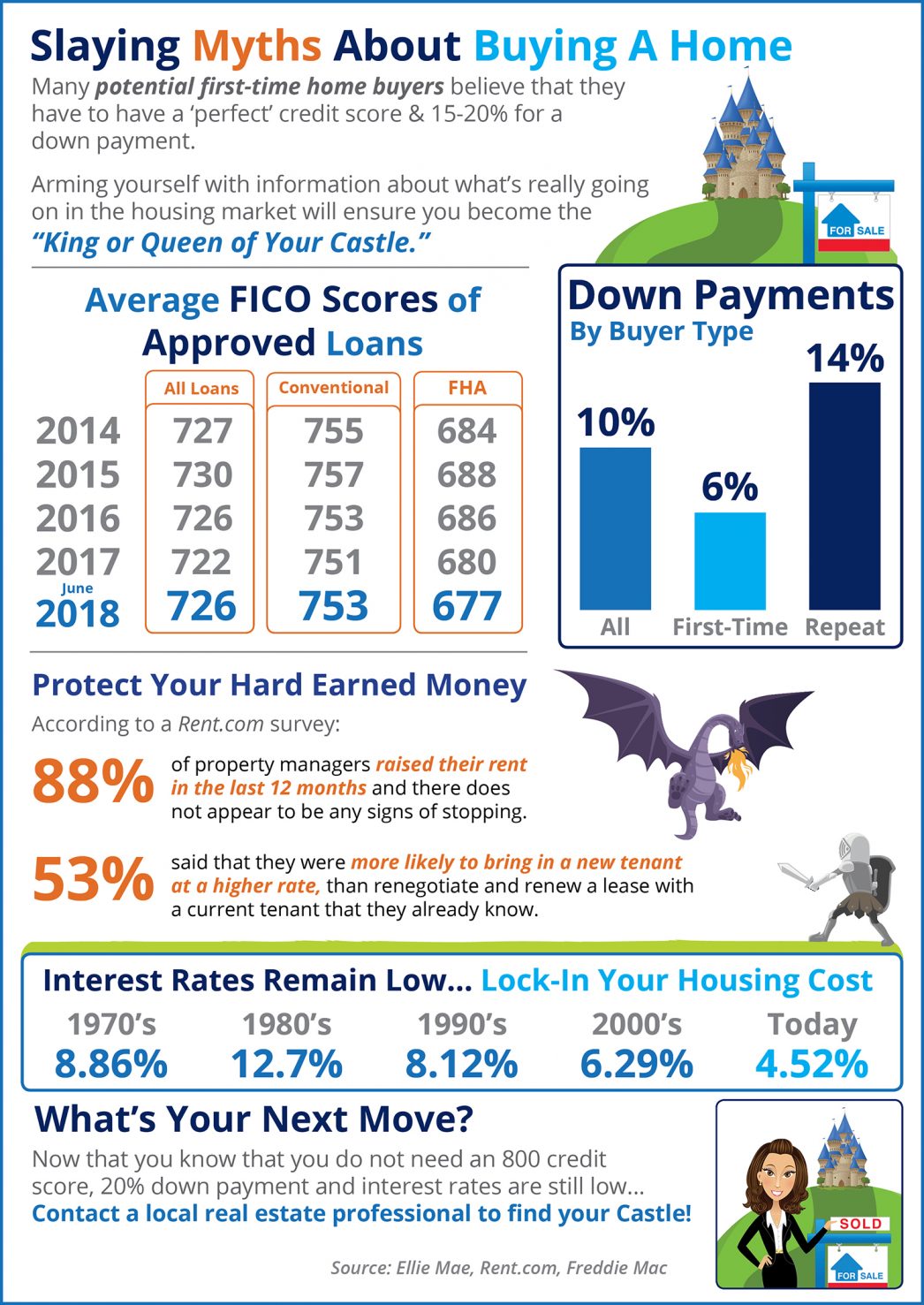

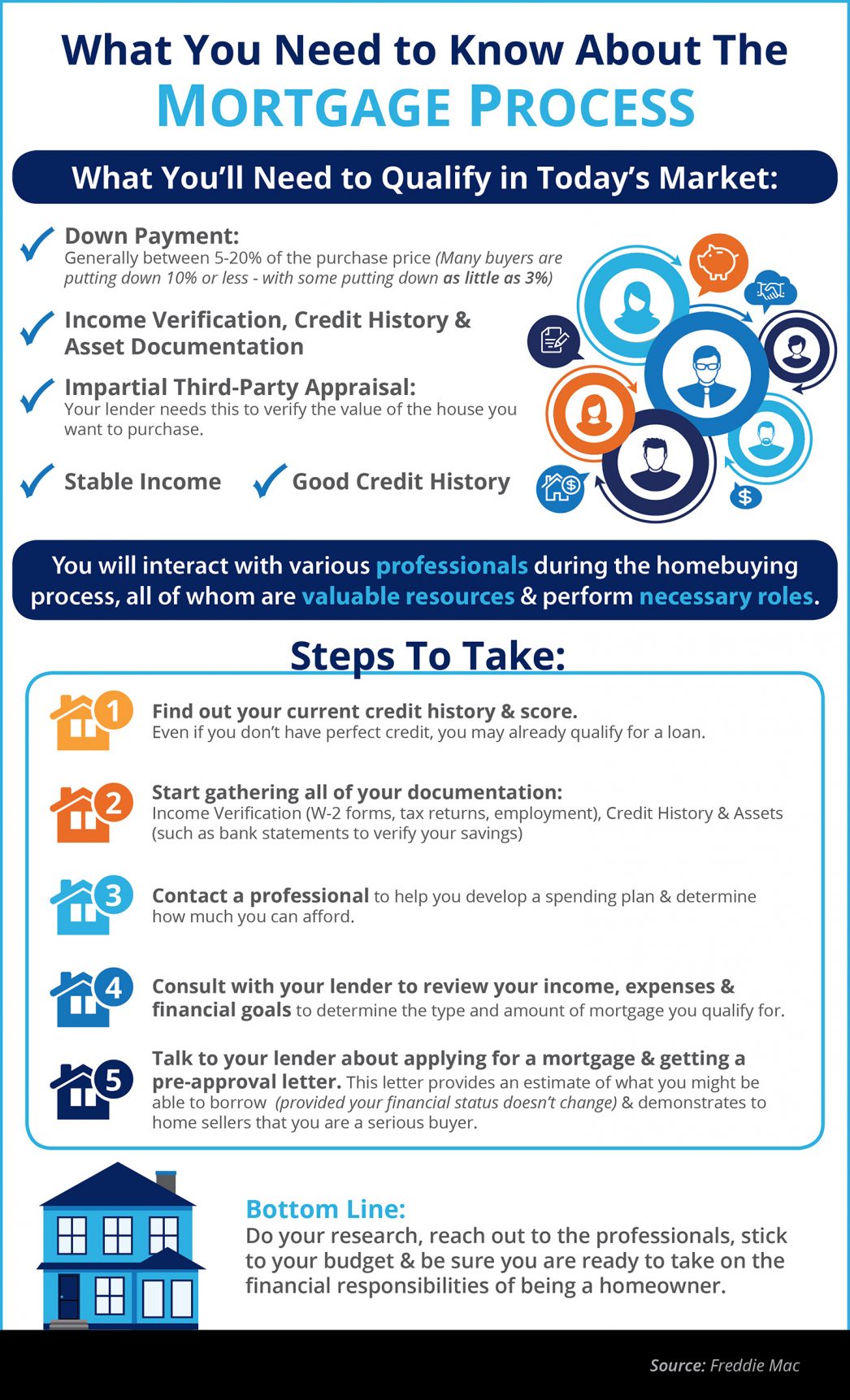

Some Highlights:

- The average down payment for first-time homebuyers is only 6%!

- Despite mortgage interest rates being over 4%, rates are still below historic numbers.

- 88% of property managers raised their rents in the last 12 months!

Hosted by Tony and Wendi Meier of Windermere Real Estate/NE

Back in 2005, Federal Reserve Chairman Alan Greenspan described the dramatic increases in residential real estate values as a “froth in housing markets.” Greenspan went on to say:

“The increase in the prevalence of interest-only loans and the introduction of more-exotic forms of adjustable-rate mortgages are developments of particular concern…some households may be employing these instruments to purchase homes that would otherwise be unaffordable, and consequently their use could be adding to pressures in the housing market.”

Greenspan was warning that the loosening of lending standards could lead to disaster. And it did.

With home prices again appreciating at percentages well above historic norms, many are wondering whether the market is again becoming “frothy.” Mortgage standards are much stricter now, however, than they were in 2005.

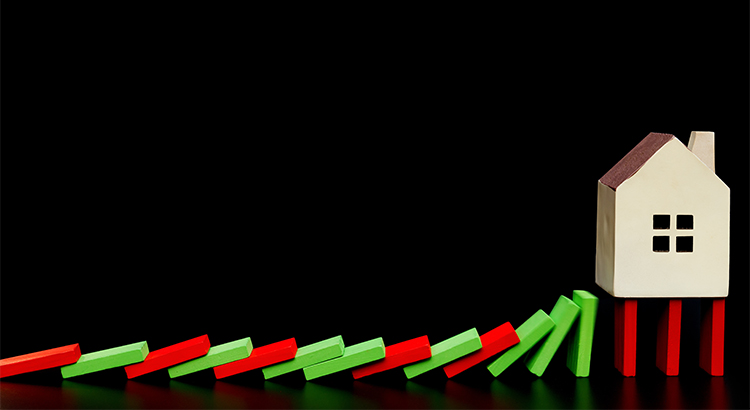

The Urban Institute’s Housing Finance Policy Center issues a monthly index which measures the percentage of home purchase loans that are likely to default. A lower score indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards. A higher score indicates that lenders are willing to tolerate defaults and are taking more risks.

Their July Housing Credit Availability Index revealed credit availability rose to 5.9%. For context, they went on to explain:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

Here is a graph depicting the Urban Institute’s findings:

Though it may be slightly easier to get a mortgage today than it was a year ago, lending standards are nowhere near where they were during the build-up to the housing bubble.

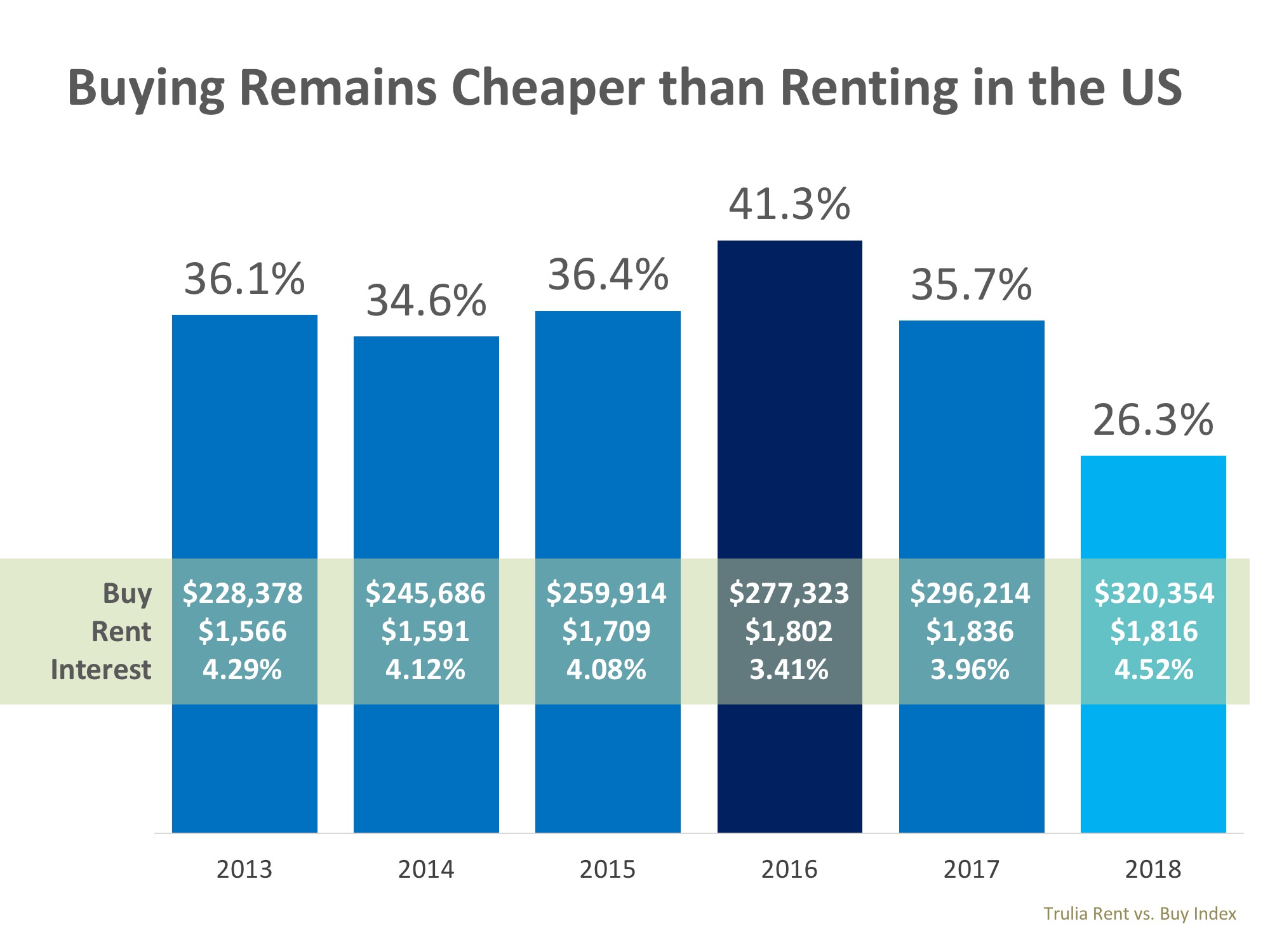

The results of the latest Rent vs. Buy Report from Trulia show that homeownership remains cheaper than renting, with a traditional 30-year fixed rate mortgage, in 98 of the 100 largest metro areas in the United States.

In the six years that Trulia has conducted this study, this is the first time that it was cheaper to rent than buy in any of the metropolitan areas.

It’s no surprise, however, that those two metros are San Jose and San Francisco, CA, where median home prices have jumped to over $1 million dollars this year. Home values in San Jose have risen 29% in the last year, while rents have remained relatively unchanged.

For the 98 metros where homeownership wins out, 97 of them show a double-digit advantage when buying. The range is an average of 2.0% less expensive in Honolulu (HI), all the way up to 48.9% in Detroit (MI), and 26.3% nationwide!

Below is a map of the 100 metros that were studied. The darker the blue dot on the metro, the cheaper it is to buy there.

In order to calculate the true cost of renting vs. buying, Trulia includes all assumed renting costs, including one-time costs (like security deposits), and compares them to the monthly costs of owning a home (insurance, mortgage payments, taxes, and maintenance) including one-time costs (down payments, closing costs, sale proceeds). They also assume that households stay in their home for seven years, put down a 20% down payment, and take out a 30-year fixed rate mortgage. The full methodology is included with the study results here.

Below is a chart created with the data from the last six years of the study, showing the impact of the median home price, rental price, and 30-year fixed rate interest rate used to calculate the ‘cheaper to buy’ metric.

In 2016, when buying was 41.3% less expensive than renting, the average mortgage rate was the driving force behind the difference. Rates this year are the highest they have been in six years which has narrowed the gap, all while home price appreciation has also been driven up by a lack of homes for sale.

Cheryl Young, Trulia’s Chief Economist, had this to say,

“One point deserves emphasizing: The ultra-costly San Francisco Bay Area is not a harbinger for the nation as a whole. While renting may outweigh buying in San Jose and San Francisco, it is unlikely that renting will tip the scales nationally anytime soon.”

Homeownership provides many benefits beyond the financial ones. If you are one of the many renters out there who would like to evaluate your ability to buy this year, let’s get together to find your dream home.

Sold for $384,000

Click Here for Details

Fantastic townhome in the Westwood Village Neighborhood of Seattle. The spacious floorplan boasts 1,010 s.f. and features 3 bedrooms, 2.25 baths, refinished wood floors and fresh paint.

The open entry welcomes you to the bottom floor of this great townhome. Downstairs you will find a bedroom with a French door to the back patio and yard with adjacent 3/4 bathroom, great for guests or roommates. Laundry closet with full-size stacked washer and dryer included.

The main floor offers a beautiful great room layout, perfect for entertaining. Kitchen features a gas stove, granite tile counters, breakfast bar, ample cabinetry and a full compliment of stainless steel appliances included. The dining room is a great space to share a meal with friends. Spacious living room with gorgeous hardwood floors and slider to a balcony overlooking the rear yard. Powder room on the main floor is great for guests.

Upstairs you will find 2 additional bedrooms with vaulted ceilings and mirrored closet doors. Adjacent full hall bathroom.

Set back from Delridge with off street parking and no HOA dues. Easy access to shopping and parks. Seattle schools – Roxhill Elementary, Denny Middle School & Sealth High.

The National Association of Realtors (NAR) released the results of their latest Existing Home Sales Report which revealed that home sales declined 0.6% to a seasonally adjusted annual rate of 5.38 million in June from 5.41 million in May, and are 2.2% below a year ago. Some may look at these numbers and think that now is a bad time to sell their house, but in fact, the opposite is true.

The national slowdown in sales is directly tied to a lack of inventory available for the buyers who are out in the market looking for their dream homes! In fact, the inventory of homes for sale had fallen year-over-year for 36 consecutive months before posting a modest 0.5% gain last month and has had an upward impact on home prices.

NAR’s Chief Economist Lawrence Yun had this to say,

“It’s important to note that despite the modest year-over-year rise in inventory, the current level is far from what’s needed to satisfy demand levels. Furthermore, it remains to be seen if this modest increase will stick, given the fact that the robust economy is bringing more interested buyers into the market, and new home construction is failing to keep up.”

The few houses that are on the market are selling fast! According to NAR’s Realtors Confidence Index, properties were typically on the market for 26 days.

If you are one of the many homeowners who is debating listing your house for sale this year, the time is now! Let’s get together to discuss the specifics of our market!

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Agent.

ECONOMIC OVERVIEW

The Washington State economy added 83,900 new jobs over the past 12 months, representing an annual growth rate of 2.5%. This is a slowdown from the last quarter, but employment growth remains well above the national rate of 1.6%. Employment gains continue to be robust in the private sector, which was up by 2.8%. The public sector (government) grew by a more modest 1.1%.

The strongest growth sectors were Retail Trade and Construction, which both rose by 4.8%. Significant growth was also seen in the Education & Health Services and Information sectors, which rose by 3.9% and 3.4%, respectively.

The State’s unemployment rate was 4.7%, down from 4.8% a year ago. Washington State will continue adding jobs for the balance of the year and I anticipate total job growth for 2018 will be around 80,000, representing a total employment growth rate of 2.4%.

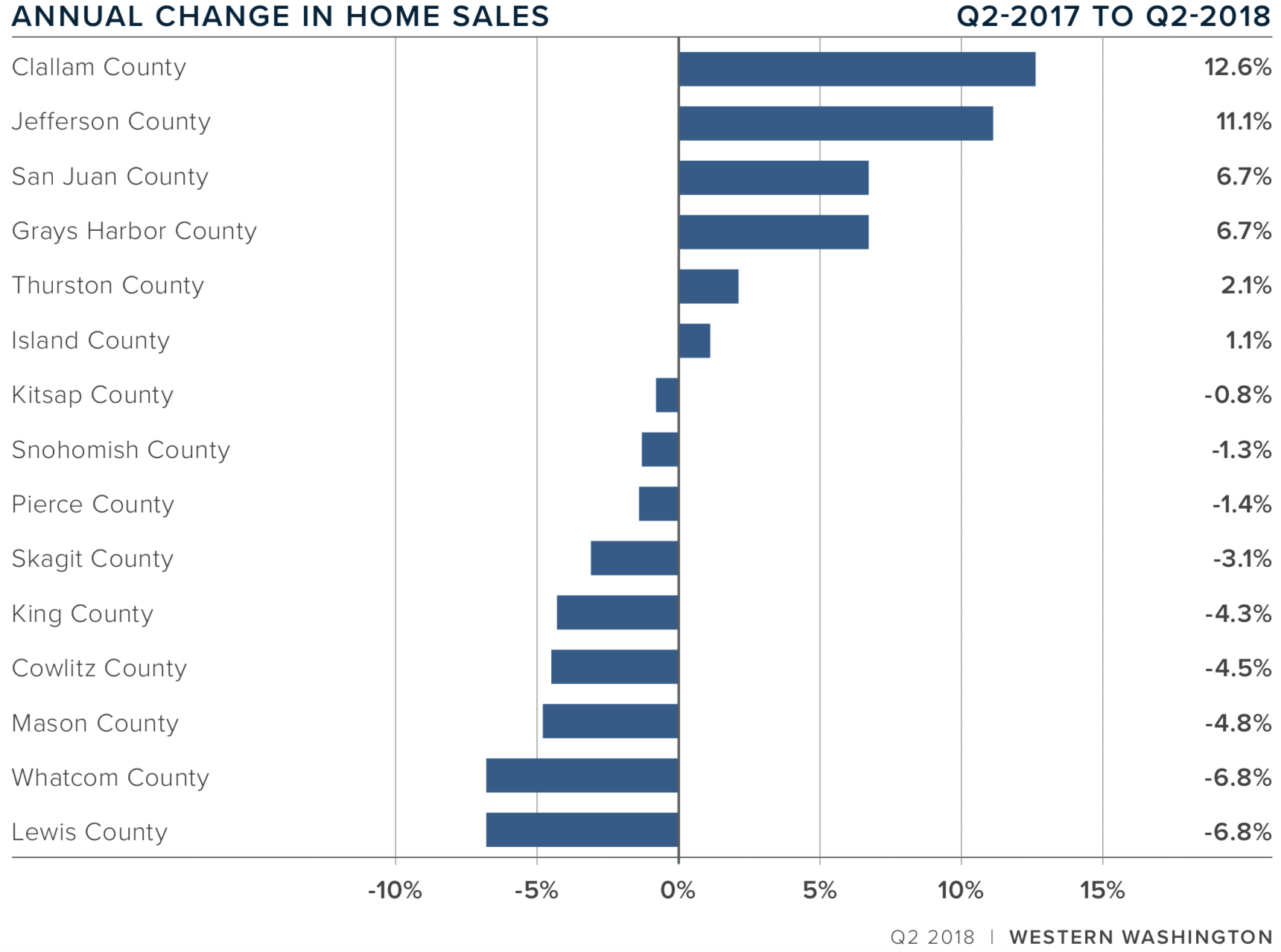

HOME SALES ACTIVITY

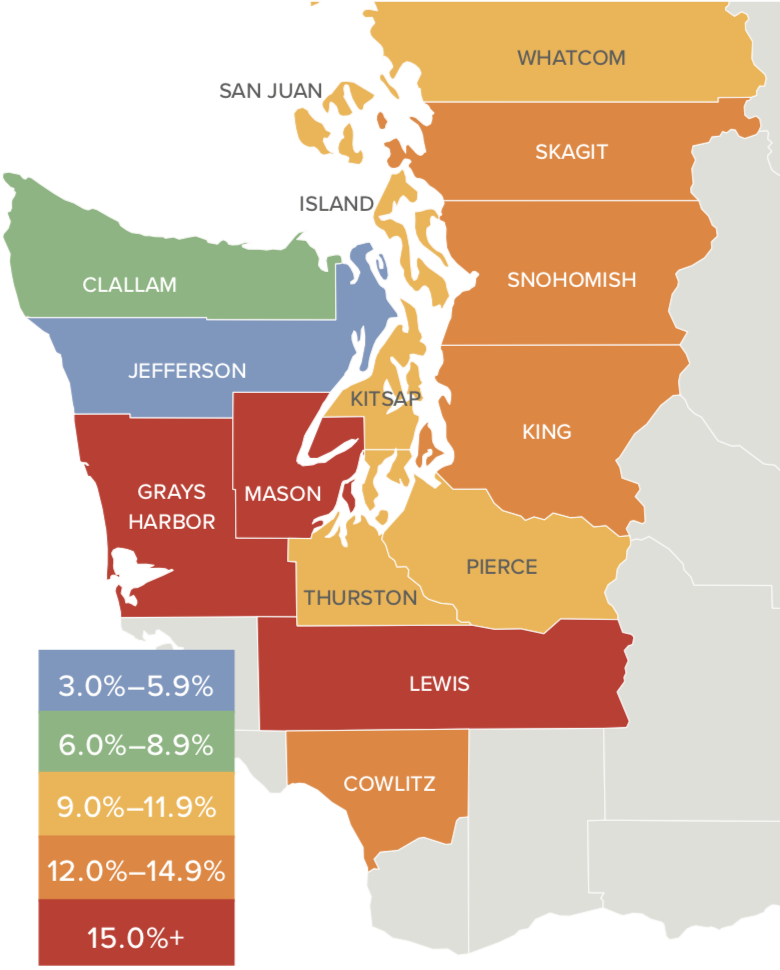

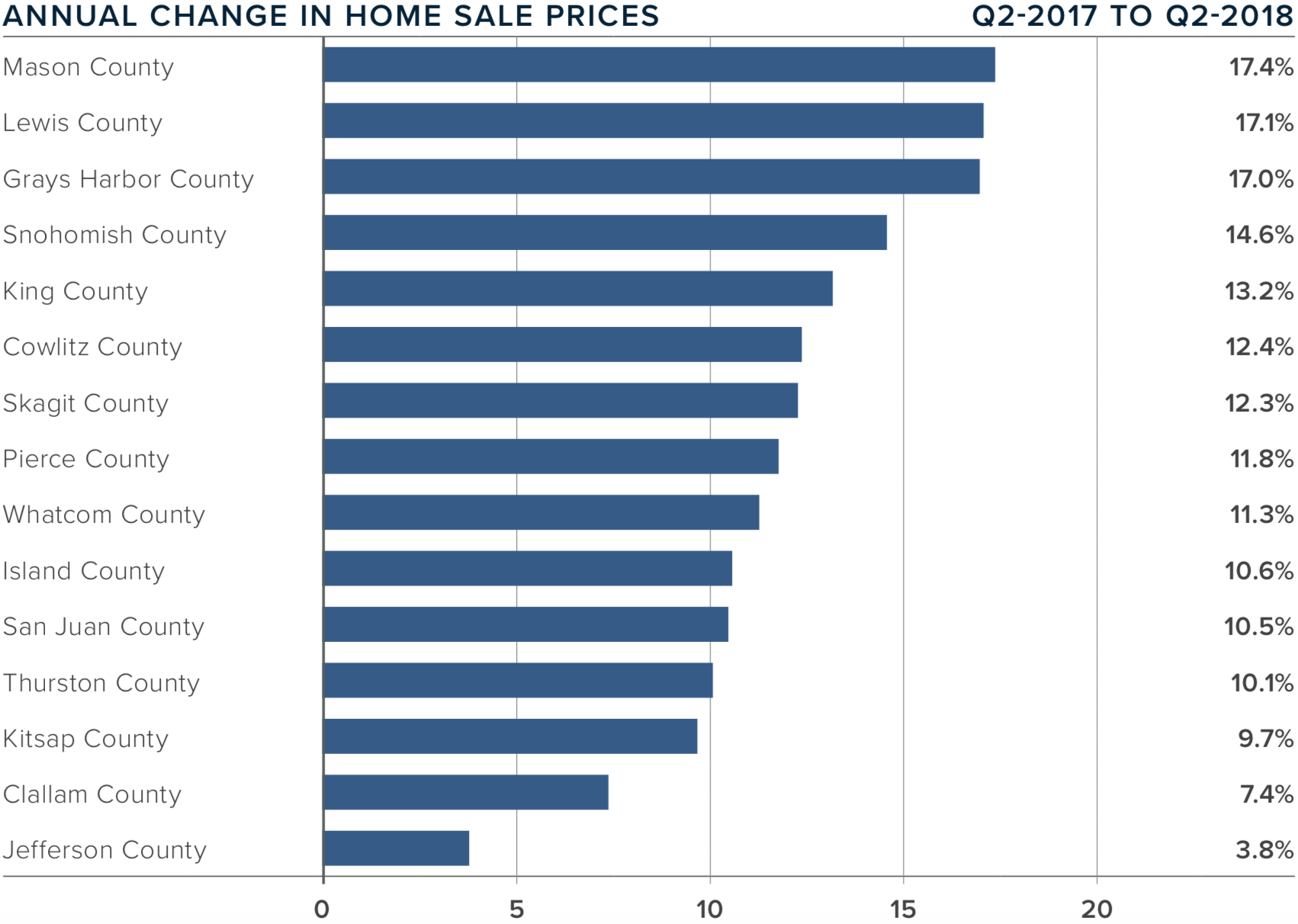

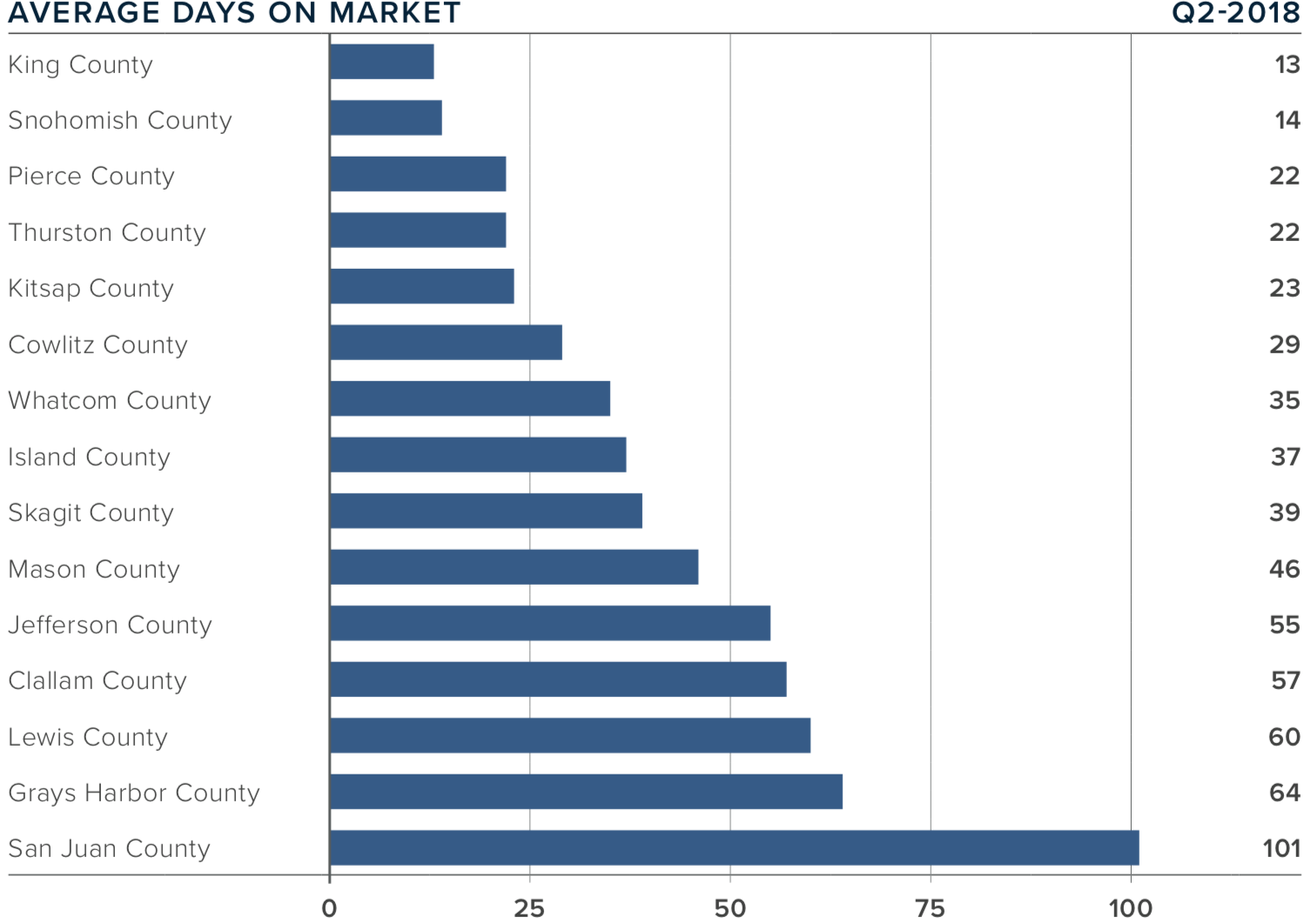

HOME PRICES

DAYS ON MARKET

CONCLUSIONS

This speedometer reflects the state of the region’s

real estate market using housing inventory, price

gains, home sales, interest rates, and larger economic factors. For the second quarter of 2018, I have moved the needle very slightly towards buyers, but it remains firmly a seller’s market. This shift is a function of price growth tapering very slightly, as well as the expectation that we should see more homes come on the market as we move through the balance of the year.

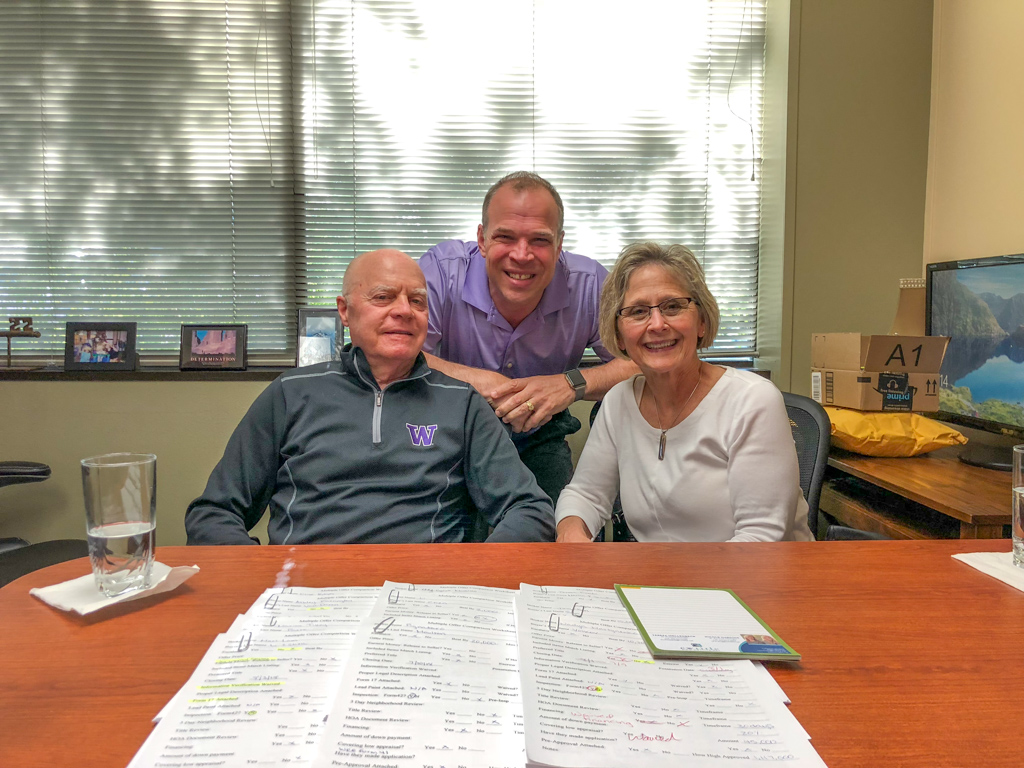

Tony Meier & Team made the selling process of our Kirkland home seem very easy and uncomplicated. They are very organized and responded very quickly with any question we had. We highly recommend them!

Mike and Jill Bishop

Sold in Kirkland – June 2018

As the real estate market continues to move down the road to a complete recovery, we see home values and home sales increasing while distressed sales (foreclosures and short sales) continue to fall to their lowest points in years. There is no doubt that the housing market will continue to strengthen throughout 2018.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory!

“Inventory coming onto the market during this year’s spring buying season…was not even close to being enough to satisfy demand, that is why home prices keep outpacing incomes and listings are going under contract in less than a month – and much faster – in many parts of the country.”

“While this spring’s sudden rise in mortgage rates [took] up a good chunk of the conversation, it’s the stubbornly low inventory levels in much of the country that are preventing sales from really taking off like they should… Most markets simply need a lot more new and existing supply to cool price growth and give buyers enough choices.”

“This seasonal inventory jump wasn’t enough to offset the historical year-over-year downward trend that has continued over 14 consecutive quarters…Despite the second-quarter gain, inventory was down 5.3% from a year ago. Still, this represents an easing of the double-digit drops we’ve been seeing since the second quarter of 2017.”

If you are thinking about selling, now may be the time. Demand for your house will be strongest while there is still very little competition which could lead to a quick sale for a great price.

We developed a plan to market, consider offers, and closed on the best deal. Tony and Team hit every target, resulting in a sale at 4.2% above asking price. We closed the deal far better than we imagined! Thanks for high-quality, and devoted service. They manage the details, in a complex transaction.

Gary and Riki Woodrell|

Sold in Renton – May 2018