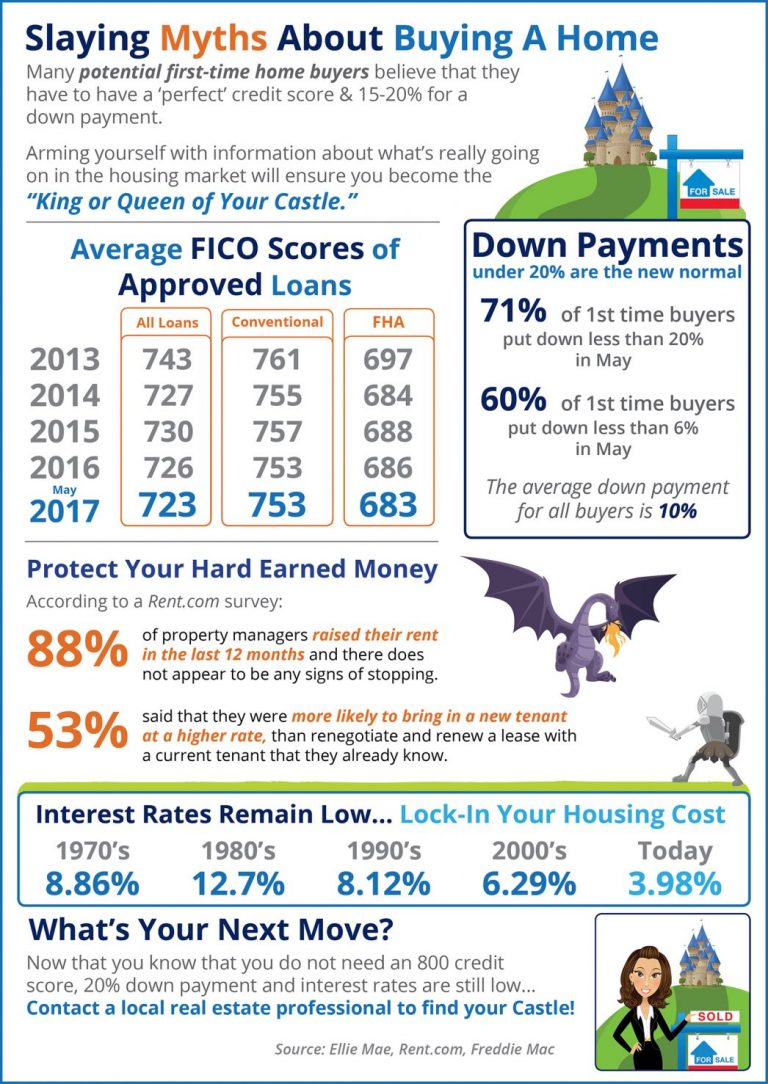

Some Highlights:

- Interest rates are still below historic numbers.

- 88% of property managers raised their rent in the last 12 months!

- The credit score requirements for mortgage approval continue to fall.

Hosted by Tony and Wendi Meier of Windermere Real Estate/NE

In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their homes on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers.

Here are the top five reasons:

Recent studies have shown that 94% of buyers search online for a home. That is in comparison to only 16% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you?

Where did buyers find the homes they actually purchased?

The days of selling your house by just putting up a sign and putting it in the paper are long gone. Having a strong internet strategy is crucial.

Here is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale by Owner:

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

The 8% share represents the lowest recorded figure since NAR began collecting data in 1981.

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission.

Studies have shown that the typical house sold by the homeowner sells for $185,000, while the typical house sold by an agent sells for $245,000. This doesn’t mean that an agent can get $60,000 more for your home, as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.

Before you decide to take on the challenges of selling your house on your own, let’s get together and discuss the options available in your market today.

![Median Days on the Market Drops to 27! [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/06/26164000/20170707-Days-on-the-Market-STM-1046x1354.jpg)

KIRKLAND, Washington (July 6, 2017) – For frustrated house hunters, there’s hope: the volume of new listings added to inventory during June (13,658) was the highest total for any single month since May 2008 (14,176 new listings), according to the latest statistics from Northwest Multiple Listing Service.

“This time of year we see more new listings coming on the market than pending sales, and June didn’t disappoint,” stated J. Lennox Scott, chairman and CEO of John L. Scott.

Noting the pace of sales is slowing and the number of multiple offers is moderating, broker Gary O’Leyar suggested a summer breather is under way (as anticipated), which could yield “the season for a successful purchase” for weary shoppers. O’Leyar, the designated broker/owner at Berkshire Hathaway HomeServices Signature Properties, said this mid-summer real estate market “seems to be following a fairly typical seasonal cycle” even though inventory is significantly lower than a year ago.

Northwest MLS director George Moorhead also commented on the “typical summer slowdown,” but said it is more noticeable in outlying areas. “The hot core areas are still quite active as buyers vie for a new home.” He also detected a slight increase in the time it is taking to market a home, and reported some cooling off in the luxury market, saying prices may be reaching a plateau.

For many brokers, rising prices are an ongoing concern, with one industry leader describing the ever-increasing prices as “startling.”

While the number of new listings was up about 7 percent year-over-year, total inventory lagged. Brokers reported 14,482 active listings of single family homes and condos at the end of June, which is down 14 percent from twelve months ago when would-be buyers could choose from 16,838 listings. Compared to the previous month, however, inventory jumped up 16 percent (12,481 vs. 14,482).

System-wide there was just over 1.4 months of inventory, but the supply varied across the 23 counties in the MLS market area. King County continued to have the tightest inventory, with less than a month of supply (0.84). Six other counties reported less than two months of supply (Cowlitz, Douglas, Kitsap, Pierce, Snohomish, and Thurston). In general, four-to-six months is considered to be a balanced market.

“Inventory continues to go lower as prices continue to climb in Kitsap County, leaving us with about 1.5 months of supply and home prices that are up more than 12 percent from a year ago,” said MLS director Frank Wilson, branch managing broker at John L. Scott in Poulsbo.

“Unlike a normal market for buyers, today’s market is not about the current inventory, rather it’s about inventory that is coming on the market,” Wilson commented. “The real story is the increased number of homes that will become available next month, and the month after.” He recommends buyers work out a success strategy with their real estate professional before even looking at their first house.

The increase in the number of new listings coupled with fewer offers for each property means more choices and a little breathing room for the backlog of buyers who have been waiting to buy a home, Scott believes. “For sellers, the market remains at a frenzy level of new listings selling in the first 30 days,” he said.

MLS brokers reported 12,397 pending sales (mutually accepted offers) during June for a gain of nearly 3.4 percent from a year ago. Compared to May, the volume of pending sales dropped slightly. Nine counties reported year-over-year decreases in the number of pending sales, with inventory shortages a likely contributing factor since most of these counties show double-digit declines in the number of active listings.

In the four-county region encompassing King, Kitsap, Pierce and Snohomish counties, MLS members notched a record-setting 9,042 pending sales, beating the previous high for the month of June that was reached in 2005. Figures show May also beat the record for that month.

“Strong job growth, price appreciation, and low interest rates continue to fuel the Puget Sound housing market,” stated Scott.

Seattle’s growing population is another likely factor. Recent U.S. Census Bureau data shows Seattle is gaining about 1,100 residents per week, an “astounding” figure, said MLS director Diedre Haines.

“June slowed a bit, probably due to it being summer – but I do not anticipate much of a slowdown this year,” remarked Haines, principal managing broker-South Snohomish County at Coldwell Banker Bain.

“In Snohomish County we are once again experiencing low appraisals,” she said, adding, “I’m not sure why this is happening, especially with regard to new construction.” Haines said new product is selling before it’s out of the ground, with many of these new homes not even hitting the market.

Northwest MLS director Scott Comey also commented on the brisk activity in Snohomish County.

“In Snohomish County, we have been seeing a lot more tech-type workers buying homes,” according to Comey, the owner/designated broker at RE/MAX Elite. “Many of my agents have clients from Microsoft, Amazon, and Google to name a few, where just a couple of years ago we rarely saw them up this way.” To get bigger bang for the buck, Comey said prospective purchasers are being pushed further north, or further south, driving up values in both Snohomish and Pierce counties. “Coupled with Boeing and other local employers doing very well, it is keeping the inventory levels under a month.”

“With interest rates still very low, we are hopeful that those who want to move up into a larger home, aren’t deterred too much,” Comey stated. Although “contingent” offers are a struggle in today’s market, he said many buyers are finding alternative methods to making the move, like bridge loans.

Reflecting strong second-quarter activity, closed sales for June topped the 10,000 mark, a first for Northwest MLS member brokers. Last month’s total of 10,094 closed sales area-wide was up almost 3 percent from the year-ago total of 9,805 closings. Year-to-date sales for the first half of 2017 are up 4.7 percent compared to the first six months of 2016.

Prices for single family homes and condos combined surged 10 percent in June compared to a year ago, rising from $350,000 to $385,000. For the four-county Puget Sound region, year-over-year prices are up about 11.4 percent. In King County, the median price of a single family home (excluding condos) jumped 13.9 percent, from $573,522 to $653,000.

Despite their upward trajectory, prices still matter, according to Northwest MLS director Dick Beeson, who cautioned sellers to “be wary” about unrealistic pricing. He reviewed more than 800 listings offered for sale in King, Pierce and Snohomish counties since January 1 that went off market as expired listings, “mainly because they were over-priced,” he suggested.

“The month-to-month price changes are startling,” remarked Mike Grady, president and COO of Coldwell Banker Bain. “Eventually we will outpace the first-time homebuyer’s ability to qualify for a mortgage and that will slow the market down somewhat,” he stated, adding, “That said, we believe the biggest challenge is that there is literally no active housing for those age 55+ being developed in the Puget Sound area. Without quality condominium development that provides a place for baby boomers wanting to downsize, they don’t move, thus blocking the next big-home buyer from moving up which in turn stops the domino effect downstream.”

“The market sizzles while sellers fiddle,” quipped Beeson, principal managing broker at RE/MAX Professionals in Gig Harbor. Noting 80-to-90 percent of sellers in the Central Puget Sound counties are accepting offers on their homes within 30 days of listing and marketing it, he acknowledged, “There is no end to the pain buyers are experiencing as they search for a home.”

On a more encouraging note Beeson urged buyers to not give up. “Diligence and prior planning are necessary to win the day. Buyers must be pre-underwritten for a loan, not just pre-approved. They must act decisively, not weakly or slowly. They must keep their composure and perseverance as they lose out on offers before finally winning.”

MLS director George Moorhead agreed. “It is not uncommon to have buyers present offers on eight or more homes before being successful; they also become more aggressive in terms of their offers.” The conversations these buyers have with their brokers also take on an entirely different level of negotiating tactics and swift decisions, according to Moorhead, the designated broker at Bentley Properties.

Buyers continue to suffer from fatigue, reported Haines. “The difference this year is that it seems buyers are more determined and not giving up. Rates have increased a bit, but this doesn’t seem to be a negative for them.” And, she added, “We still struggle with the issue of them waiving their protective rights despite our counsel not to.” Haines said sellers are starting to become adamant that they do not want multiple buyers conducting pre-inspections, but commented, “This is a trend I personally hope continues.”

Wilson also offered advice to buyers. “They need to be clear as to what they will accept, or not. Get pre-underwritten by their lender, be ready for a fast tracked inspection, strong earnest money, strong financing and amount down and put forward the most streamlined offer their situation will allow.”

Commenting on the latest MLS statistics, Grady said the numbers “tell the continuing story of a very tight market created by the situation of a region where far more jobs are being created than new housing units — whether they are apartments, condos or single-family homes. This pattern won’t change until developers can out-build net new job creation, especially in the greater Puget Sound area.”

Condos, once the path to ownership for first-time buyers, offer sparse options. Inventory is down 24 percent from a year ago. Condos currently only account for about 8 percent of all active listings, and there is less than a month’s supply.

Condo prices, while more affordable than many single family homes, continue to trend upward. The median sales price for last month’s closed sales of condos was $328,675, an increase of nearly 9.6 percent from a year ago.

Based on his analysis of MLS data, Moorhead noted condos have appreciated in the double digits for the last three years as they play catch-up to single family homes sales. “Condos are typically the next best option for first time buyers who cannot keep up with a surge in pricing from single family homes; however, even condos are being priced out of reach for many new buyers.”

The market frenzy prompts questions about a housing bubble.

“We are often asked about how long this will market last,” said Wilson. His reply? “Jobs in Seattle are still getting stronger, the economy is not yet at full strength, incomes are starting to rise, loan interest rates are low, money is relatively easy to borrow, gas prices are low, the stock market is doing well and the public’s attitude seems to be good. This could last a few years.”

Northwest Multiple Listing Service, owned by its member real estate firms, is the largest full-service MLS in the Northwest. Its membership of more than 2,200 member offices includes more than 26,000 real estate professionals. The organization, based in Kirkland, Wash., currently serves 23 counties in the state.

The Joint Center of Housing Studies (JCHS) at Harvard University recently released their 2017 State of the Nation’s Housing Study, and a recent blog from JCHS revealed some of the more surprising aspects of the study.

The first two revelations centered around the shortage of housing inventory currently available in both existing homes and new construction.

“For the fourth year in a row, the inventory of homes for sale across the US not only failed to recover, but dropped yet again. At the end of 2016 there were historically low 1.65 million homes for sale nationwide, which at the current sales rate was just 3.6 months of supply – almost half of the 6.0 months level that is considered a balanced market.”

“Markets nationwide are still feeling the effects of the deep and extended decline in housing construction. Over the past 10 years, just 9 million new housing units were completed and added to the housing stock. This was the lowest 10-year period on records dating back to the 1970s, and far below the 14 and 15 million units averaged over the 1980s and 1990s.”

The biggest challenge in today’s market is getting current homeowners and builders to realize the opportunity they have to maximize profit by selling and/or building NOW!!

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. Two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now continues to be a great time to sell your house.

Let’s look at the data covered in the latest REALTORS® Confidence Index and Existing Home Sales Report.

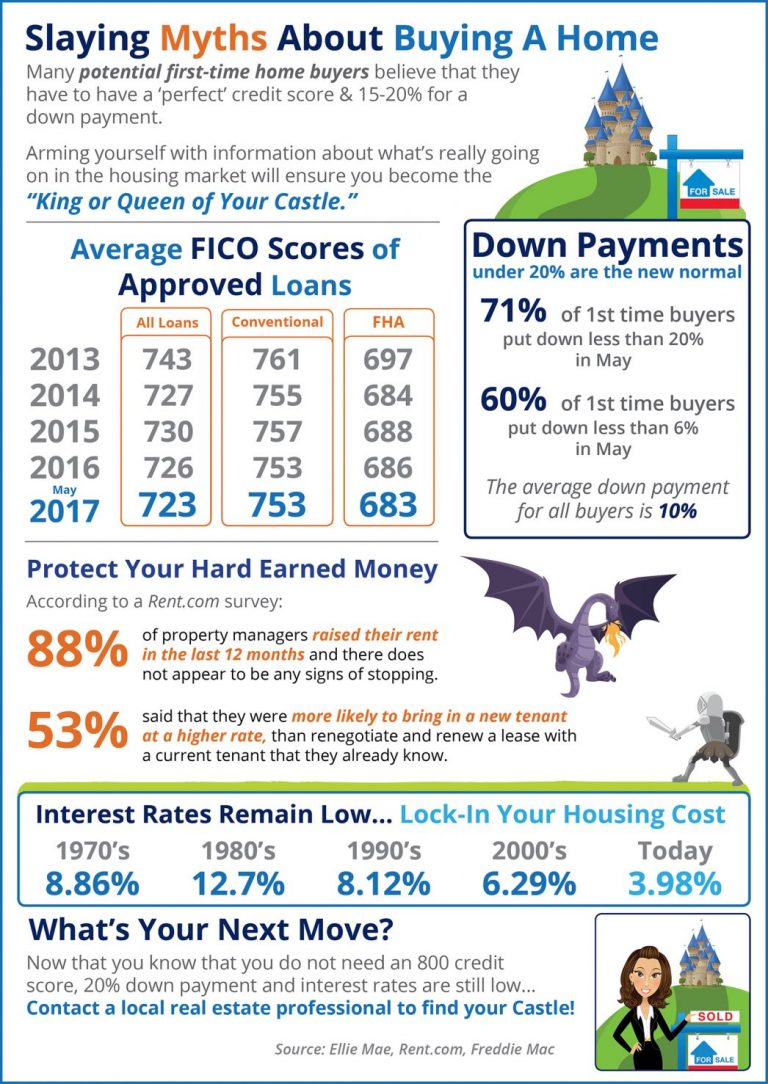

Every month, NAR surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions.”This month, the index showed (again) that home-buying demand continued to outpace supply in May.

The map below illustrates buyer demand broken down by state (the darker your state, the stronger the demand is there).

In addition to revealing high demand, the index also mentioned that “compared to conditions in the same month last year, seller traffic conditions were ‘weak’ in 24 states, ‘stable’ in 25 states, and ‘strong’ in D.C and West Virginia.”

Takeaway: Demand for housing continues to be strong throughout 2017, but supply is struggling to keep up, and this trend is likely to continue into 2018.

The most important data revealed in the report was not sales, but was instead the inventory of homes for sale (supply). The report explained:

According to Lawrence Yun, Chief Economist at NAR:

“Current demand levels indicate sales should be stronger, but it’s clear some would-be buyers are having to delay or postpone their home search because low supply is leading to worsening affordability conditions.”

In real estate, there is a guideline that often applies; when there is less than a 6-month supply of inventory available, we are in a seller’s market and we will see appreciation. Between 6-7 months is a neutral market, where prices will increase at the rate of inflation. More than a 7-month supply means we are in a buyer’s market and should expect depreciation in home values.

As we mentioned before, there is currently a 4.2- month supply, and houses are going under contract fast. The Confidence Indexshows that 55% of properties were on the market for less than a month when sold.

In May, properties sold nationally were typically on the market for 27 days. As Yun notes, this will continue, unless more listings come to the market.

“With new and existing supply failing to catch up with demand, several markets this summer will continue to see homes going under contract at this remarkably fast pace of under a month.”

Takeaway: Inventory of homes for sale is still well below the 6-month supply needed for a normal market. And the supply will continue to ‘fail to catch up with demand’ if a ‘sizable’ supply does not enter the market.

If you are going to sell, now may be the time to take advantage of the ready, willing, and able buyers that are still out searching for your house.

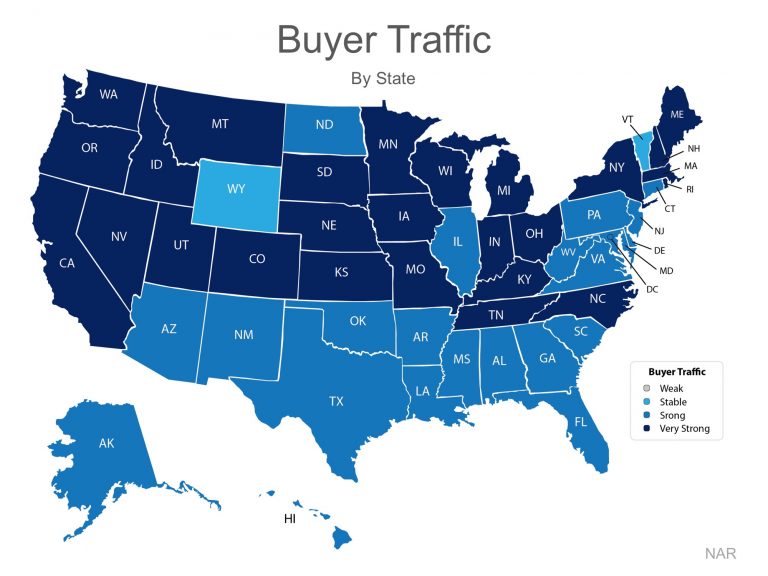

Interest rates have hovered around 4% for the majority of 2017, which has given many buyers relief from rising home prices and has helped with affordability. Experts predict that rates will increase by the end of 2017 and will be about three-quarters of a percentage point higher, at 4.5%, by the end of 2018.

Last week’s Freddie Mac Primary Mortgage Market Survey revealed that interest rates for a 30-year fixed rate mortgage have fallen to their lowest mark this year, at 3.88%. This is great news for homebuyers looking to purchase and homeowners looking to refinance.

The rate you secure greatly impacts your monthly mortgage payment and the amount you will ultimately pay for your home.

Let’s take a look at a historical view of interest rates over the last 45 years.

Be thankful that you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago.

Dear Tony,

You know your business!

My Mom and I made the right decision when we decided to hire you to list her Redmond house to sell. Although we did interview a few other realtors including Redfin, you definitely were more knowledgeable and experienced in the English Hill area and the benefits of your system of optimizing negotiations in a Seller’s market were obvious and proven.

Your referrals for the wide range of service providers we needed (house cleaners, window cleaners, repairman, movers, etc.) were invaluable and certainly saved us time and headaches especially since we were moving my Mom and her possessions across country and the house would be vacant. When I ran into any issues we really appreciated that you jumped on the phone to see if you could move things along or help resolve any issues without being asked.

We appreciated your professionalism and your consistent responsiveness throughout the entire process from the beginning when we scheduled an appointment to interview you, to preparing the house that my Mom had lived in for more than 25 years, to putting it on the market and presenting it at its best, to reviewing and negotiating the offers, to answering all our questions, to follow up and follow through on the various things that had to happen to actually close escrow and following up after escrow closed.

Even in a hot Seller’s market, I think we were all shocked (but pleasantly surprised) at the sale price. Credit does go to you for knowing how to market the property and to optimize the negotiations to get the best outcome for your client and the follow through to close the deal. Your experience, hard work, consistent and tireless efforts, bag of honed skills, and focus, served us exceptionally well. I am a very detailed person and genuinely appreciated your patience and attitude taking the time to always efficiently address any issues, concerns and questions I had throughout the entire process.

Thank you for everything you did to lighten the load during a very stressful time in both my Mom’s and my life and your contributions to an exceptional outcome she and I didn’t even imagine.

Sincerely,

Karen Chamberlain and Grace Francis-Lau

Sold in Olde Morrison June 2017

The National Association of Realtors (NAR) recently released the findings of their Q2 Homeownership Opportunities and Market Experience (HOME) Survey. The report covers core topics like, “if now is a good time to buy or sell a home, the perception of home price changes, perceived ability to qualify for a mortgage, and [an] outlook on the U.S. economy.”

The survey revealed that 75% of homeowners think now is a good time to sell, compared to 70% last quarter. This is a considerable increase from more than a year ago when 66% agreed.

Even though homeowners believe that now is a good time to sell, many have not taken the step to list their homes, as inventory shortages still exist across the country. Lawrence Yun, NAR’s Chief Economist, had this to say:

“There are just not enough homeowners deciding to sell because they’re either content where they are, holding off until they build more equity, or hesitant seeing as it will be difficult to find an affordable home to buy…

As a result, inventory conditions have worsened and are restricting sales from breaking out while contributing to price appreciation that remains far above income growth.”

If you are wondering if now is a good time to sell your house, let’s get together to discuss the opportunities available in our market.