Some Highlights:

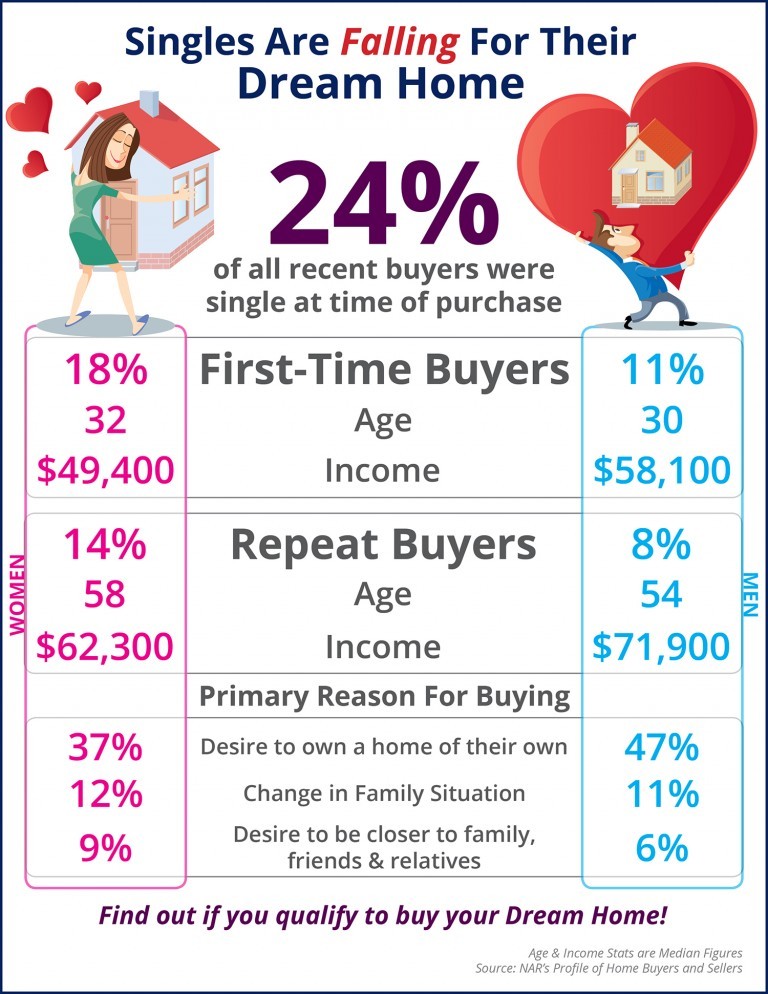

- 24% of all recent home buyers were single at the time of purchase.

- 47% of single men cite the desire to own a home of their own as the primary reason to buy.

- 18% of first-time buyers were single women.

Hosted by Tony and Wendi Meier of Windermere Real Estate/NE

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is “an online resource for the most rigorous research and practical information on how a quality, stable, affordable home in a vibrant community contributes to individual and community success”.

A recent story they published, The First Rung on the Ladder to Economic Opportunity Is Housing, discussed the importance of having affordable housing available to as many families as possible because:

“The ladder to economic success can stretch only so high without the asset-building power of homeownership.

Home equity provides Americans with the ability to send their children to college with less student loan debt and is the primary source of funds for retirement. Half of the assets of Americans over age 55 are in their home.”

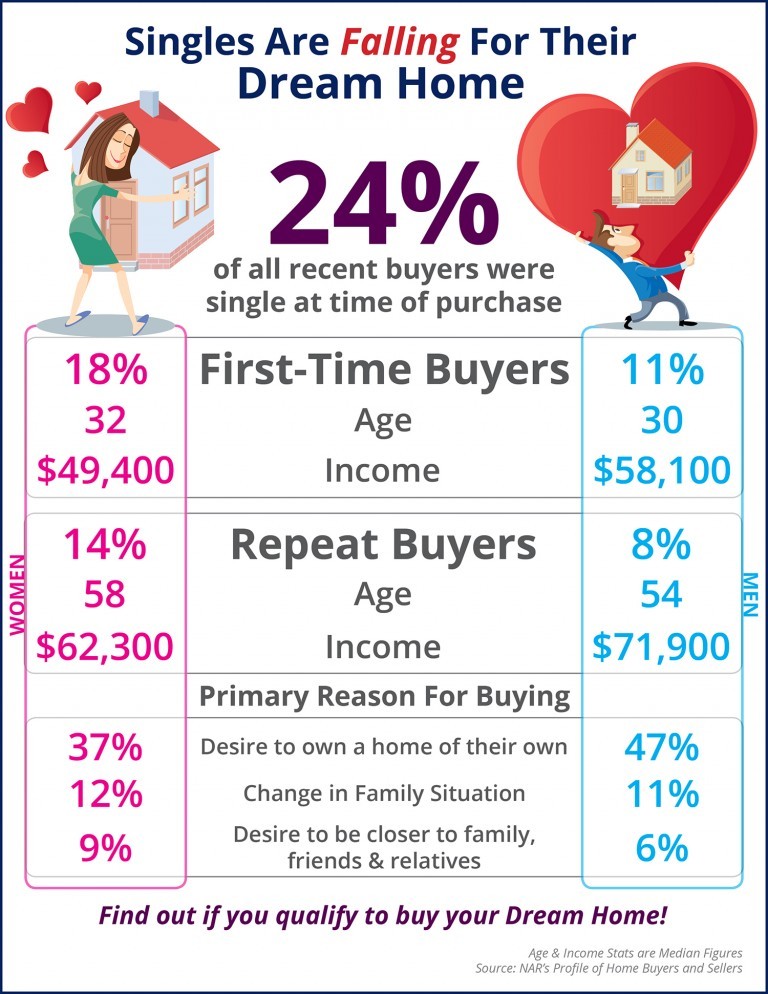

I have often posted that the net worth of a family owning a home is 45 times greater than that of a family that rents. That is not a coincidence.

A few weeks ago, Jonathan Smoke, the Chief Economist at realtor.com, exclaimed: “All indicators point to this spring being the busiest since 2006.”

Now, Freddie Mac has doubled down on that claim and is saying that 2016 will be the best year that the real estate industry has seen in a decade. In their March Housing Outlook Report,Freddie Mac explained:

“Despite the challenges facing the housing market, we expect this to be the best year for housing in a decade. Home sales, housing starts, and house prices will reach their highest level since 2006 according to our latest forecast…Challenges remain, with low housing supply and declining affordability being a key concern in many markets, but on balance, the housing markets in the U.S. are poised for the best year since 2006.”

The key indicators that have given Freddie Mac such a positive outlook are:

2016 looks to be shaping up as a great year for residential real estate. Whether you are thinking of buying or selling, we should meet up to discuss the new opportunities that are arising in your market.

There are some renters that have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage – either your mortgage or your landlord’s.

As The Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return.

That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

Christina Boyle, a Senior Vice President, Head of Single-Family Sales & Relationship Management at Freddie Mac, explains another benefit of securing a mortgage vs. paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

The graph below shows the widening gap in net worth between a homeowner and a renter:

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, owning might make more sense than renting with home values and interest rates projected to climb.

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. Prices are still below those of a few years ago and interest rates have stayed near historic lows.

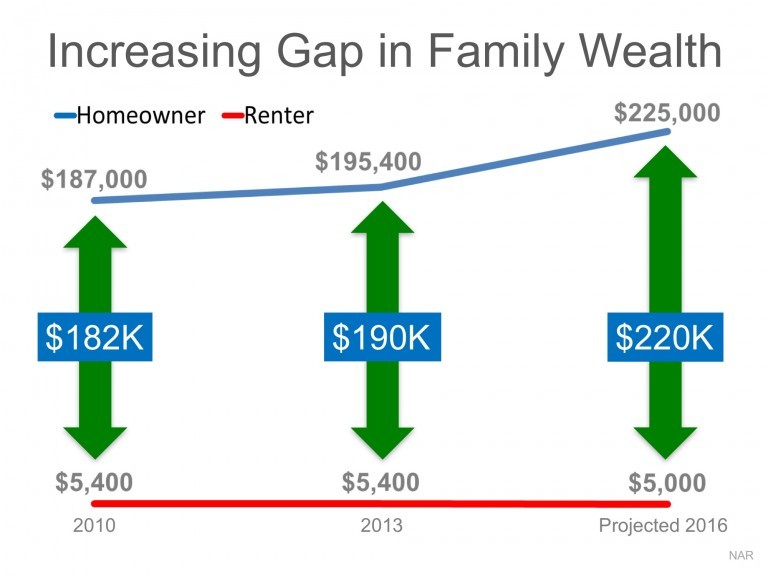

Sellers should realize that waiting to make the move when mortgage rates are projected to increase probably doesn’t make sense. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain budget for your monthly housing costs.

According to Freddie Mac, the current 30-year fixed rate is currently around 3.75%. With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, by $10,000).

Freddie Mac predicts that mortgage rates will be closer to 4.7% by this time next year.