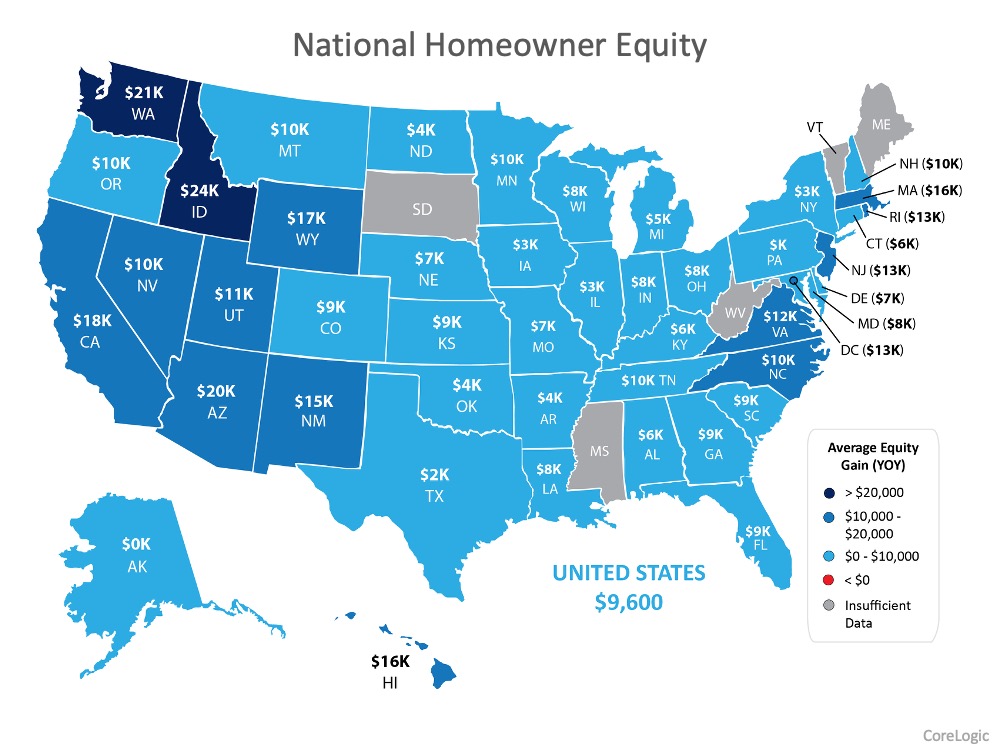

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

One of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights Report from CoreLogic, in nearly every state there was a year-over-year first-quarter equity increase, averaging out to a 6.5% overall gain.

The report notes:

“CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $590 billion since the first quarter of 2019, an increase of 6.5%, year over year.” (See map below):

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

That’s a huge win for homeowners, especially for those looking to sell their houses and make a move this summer. Having equity to re-invest in your next home is a major force that can make moving a reality, especially while buyers are expressing such a high demand for homes to purchase.

Frank Martell, President and CEO of CoreLogic addresses the potential long-term outlook and how homeowners will likely fare much more positively through the current recession than many did during the last one:

“Many homeowners will experience a recession during their lifetime, and it is reasonable to compare the current recession to those in the past. But the comparison is not apples to apples — every recession is different. Primary drivers of the Great Recession were an overbuilt housing stock, risky mortgages and the collapse of home prices, creating a massive increase in negative equity that proved difficult to recover from. Today’s housing environment has low vacancy and delinquency rates and a large home equity cushion.”

Bottom Line

Now is a great time to consider leveraging your equity and making a move, especially while buyer interest is high. Let’s connect to explore your equity position and make your next move a reality.

NWMLS May 2020 Real Estate Market Report – Housing activity in Western Washington shows resiliency as buyers, sellers and brokers adjust to COVID-19 restrictions

KIRKLAND, Washington (June 5, 2020) – “The market has proved to be very resilient,” remarked Northwest Multiple Listing Service director Mike Larson upon reviewing the statistical report for May. “Buyers in Pierce County stepped on the gas last month after a brief, but significant, tap of the brakes in April,” added Larson, the president and designated broker at ALLEN Realtors in Lakewood.

Despite the economic downturn and disruptions stemming from the coronavirus pandemic, Northwest MLS member-brokers reported impressive improvement from April to May on some key indicators. The volume of new listings, including single family homes and condominiums, rose 29.2% and pending sales jumped more than 44% system wide.

Not surprisingly, year-over-year comparisons showed sharp declines. The number of new listings fell nearly 33%, total active listings plummeted nearly 36%, pending sales declined 13.5%, and closed sales dropped about 35%. Prices remained in positive territory, rising about 2.3% from a year ago.

“The resiliency of the market is amazing,” remarked Dean Rebhuhn, owner of Village Homes and Properties in Woodinville. “I didn’t think I would miss open houses until they could not happen,” he said, referring to limitations on in-person interactions. “The pandemic may be causing buyers to move farther out, wanting to get some space and a useable yard.” Amenities such as parks and trails are also important in current homebuying decisions, he added.

Brokers and homebuyers alike seem to be adjusting to restrictions imposed on the real estate industry because of the coronavirus pandemic.

“The local real estate market is hot, but it looks different than it traditionally does,” remarked J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “The constraint on available inventory makes it feel like we’re running out of homes to sell.”

Brokers added 9,871 new listings to the MLS database during May, which compares to 14,689 for the same period a year ago. At month-end the selection included 10,357 active listings; that volume was 5,766 fewer than the year ago total of 16,133.

Stated another way, at the end of May there was 1.74 months of supply across the 23 counties served by Northwest MLS. Inventory levels ranged from 1.1 months of supply in Thurston County to more than 8 months in San Juan County. Within the four-county Puget Sound region, supply ranged from 1.2 months in Pierce County to 1.74 months in King County.

Scott said buyers are “eagerly waiting for each home to come on the market with increased focus on homes in the more affordable and mid-price ranges.”

“Anything under $1 million is selling quickly, and most new listings coming to market are going pending

in just a few days,” stated Mike Grady, president and COO at Coldwell Banker Bain. Multiple offers seem to be in play on homes in median price ranges. “We don’t think we’ll see a balancing of the market in the short term until more sellers decide to list their homes and until new construction accelerates to meet demand.” He noted activity was showing steady improvement in each passing week and month. “The stories I hear continue to be filled with improving outlooks and activity so we’re cautiously optimistic about what summer will bring.”

Larson agreed, saying “Multiple offers and waived inspections are common as we head into the prime selling season. Underwriting requirements have tightened a bit, but rates are still very low.”

Commenting on Gov. Jay Inslee’s “Stay Home, Stay Healthy” order in effect since March and the more recent “Safe Start Proclamation,” Northwest MLS director John Deely said the challenge was met with new processes and tools to help comply with social distancing and other protocols. “Brokers jumped in with both feet to produce and use a new live streamed open house feature released by the MLS in late April,” added Deely, the principal managing broker at Coldwell Banker Bain in Seattle. “Buyers could also use virtual tours to view homes, recorded virtual tours, videos, 3-D tours, drone photos and interactive floor plans,” he added.

Appointments to show properties under the limitations of a broker and one or two others (depending on the county where the property is located) “were booked solid from dawn to dusk in many areas,” according to Deely. “Multiple offers and a competitive environment prevailed through the month of May. We found many sellers accelerated their plans to sell upon hearing the forecast for an extended “stay home” order. Many buyers were impacted by layoffs or furlough and had to put their home purchase plans on hold for now.”

The NWMLS report shows 10,389 pending sales during May, improving on April’s total of 7,207 (up 44%), but down about 13.5% from the year-ago total of 12,006.

NWMLS director Frank Leach, broker/owner at RE/MAX Platinum Services in Silverdale, said sales are brisk in the $350,000 and below range, and sales of $1 million and up are gaining. “The tempo of the market seems to be very hot, with buyers trying to take advantage of lower interest rates, and both lenders and real estate agents scrambling to meet demand.”

Leach believes this is “likely one of the best markets we have ever seen both in interest rates and affordability. People who are betting there will be a bubble burst are going to miss the market.”

NWMLS members completed 5,957 transactions during May, a slight improvement from April’s total of 5,866. When compared to a year ago, however, the number of closed sales, at 9,153, marked a decline of about 35%.

The median price on last month’s closed sales was $449,950 across the NWMLS coverage area. That compares to the year-ago figure of $440,000 an increase of about 2.3%.

Five of the 23 counties in the report had year-over-year price drops: Ferry (-30%), King (-2.8%), Kittitas (-2.95%), Pacific (-12.8%), and San Juan (-17.8%). The biggest increases were in Okanogan County (30.3%) and Grays Harbor County (15.7%).

“I don’t think anyone should be surprised that home prices in King County took a ‘breather’ in May,” said Matthew Gardner, chief economist at Windermere Real Estate. “Clearly COVID-19 was the cause for this drop, but I’m confident this is a temporary situation that will be reversed as King County starts to reopen, and fresher inventory comes to market.” The robust increase in listings between April and May combined with pervasively low mortgage rates “tells me prices will resume their upward trend in the coming months,” he added.

Leach said when Kitsap County moved into Phase 2 of the governor’s reopening plan, the Kitsap

Department of Community Development processed over 400 permits, which he believes “is just the tip of the iceberg as builders rush to meet consumer demand. Builders are now seeing folks who commuted to work looking to purchase homes with an extra den or office as they anticipate the “work from home” aspect is here to stay.”

Grady also commented on the slight price drop in King County, saying he believes it’s a reflection of reduced activity in the luxury home market ($2+ million), which disproportionately impacts over price averages. “This may be a reflection of a ‘wait and see’ attitude or just the uncertain times we’re in.”

Northwest Multiple Listing Service is a not-for-profit, member-owned organization that facilitates cooperation among its member real estate firms. With more than 2,300 member firm offices and 30,000 brokers across Washington state, NWMLS (www.nwmls.com) is the largest full-service MLS in the Northwest. While based in Kirkland, Washington, its service area spans 23 counties and it operates 20 local service centers.

Three Things to Understand About Unemployment Statistics

Tomorrow morning the Bureau of Labor Statistics will release the latest Employment Situation Summary, which will include the most current unemployment rate. It will be a horrific number. Many analysts believe unemployment could be greater than 20%. These numbers represent families across the nation that are not sure when (or if) they will return to work. The emotional impact on these households is devastating.

There are, however, some small rays of light shining through on this issue. Here are three:

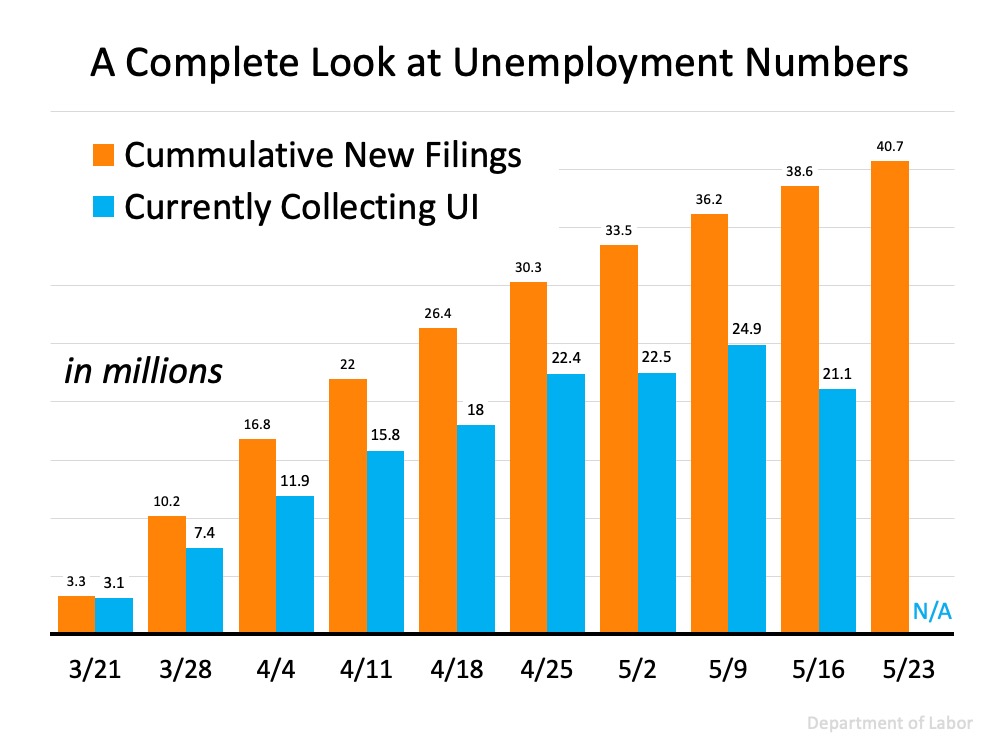

1. The actual number of unemployed is less than many are reporting

The number of people unemployed is sometimes over-exaggerated. It seems that every newscaster talks about the 40+ million people “currently” unemployed. It is true that, over the last ten weeks, over 40.7 million people have applied for unemployment. It is also true, however, that many of those people have already returned to work or gotten a new job. The actual number of people currently unemployed is 21.1 million. This is still a horrible number, but about half of what is often being reported.

2. Of those still unemployed, most are temporary layoffs

Last month’s unemployment report showed that 90% of those unemployed believe their status is temporary. Friday’s report will probably show a decline in that percentage as the original number was somewhat optimistic. However, a recent survey by the Federal Reserve Bank showed that employers believe over 75% of job losses are temporary layoffs and furloughs. This means 3 out of 4 people should be returning to work as the economy continues to recover.

3. Those on unemployment are receiving assistance

According to a recent study from the Becker Friedman Institute for Economics at the University of Chicago, 68% of those who are eligible for unemployment insurance receive benefits that exceed lost earnings, with 20% receiving benefits at least twice as large as their lost earnings.

Bottom Line

Tomorrow’s report will be difficult to digest. However, as the nation continues to reopen, many of those families who are impacted will be able to return to work.

Is it Time to Sell Your Vacation Home?

The travel industry is one of the major sectors that’s been hit extremely hard by the COVID-19 pandemic. Today, it’s hard to know how long it will take for summer travelers to be back in action and for the industry to fully recover. Homeowners who rent their secondary properties on their own or through programs like Airbnb, which has over 660,000 listings in the U.S. alone, have been impacted in this challenging time. Some of these homeowners are considering selling their vacation homes, and understandably so.

A recent CNN article indicated:

“With global travel screeching to a halt during the pandemic, a number of Airbnb hosts are planning to sell their properties…These desperate moves come as hosts face the possibility of losing thousands of dollars a month in canceled bookings while bills, maintenance costs, and mortgage payments pile up.”

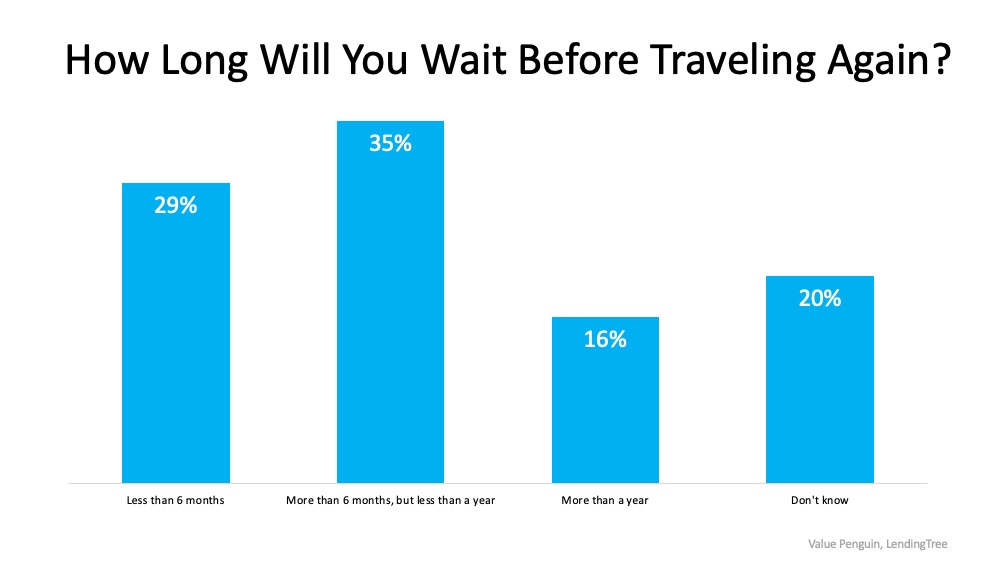

If you’re one of the property owners in this position, you too may be feeling the pain of decreased travel, especially as we prepare for the typical busy summer vacation season. A recent survey notes that 48% of Americans have already canceled summer travel plans due to the current health crisis. In addition, 36% indicated they don’t have vacation plans, and only 16% said they did not cancel their summer travel.

The same survey also asked, “How long will you wait before traveling again?” Not surprisingly, only 29% of respondents are planning to travel within the next 6 months. That means 71% are putting their plans on hold for at least 6 months, or are still unsure about future travel. That can continue to add to the significant income loss that many property renters felt this spring. If you’re considering selling your rental property, know that there are two key factors indicating that selling your vacation home now may be your best move as a homeowner.

If you’re considering selling your rental property, know that there are two key factors indicating that selling your vacation home now may be your best move as a homeowner.

1. Inventory Shortage

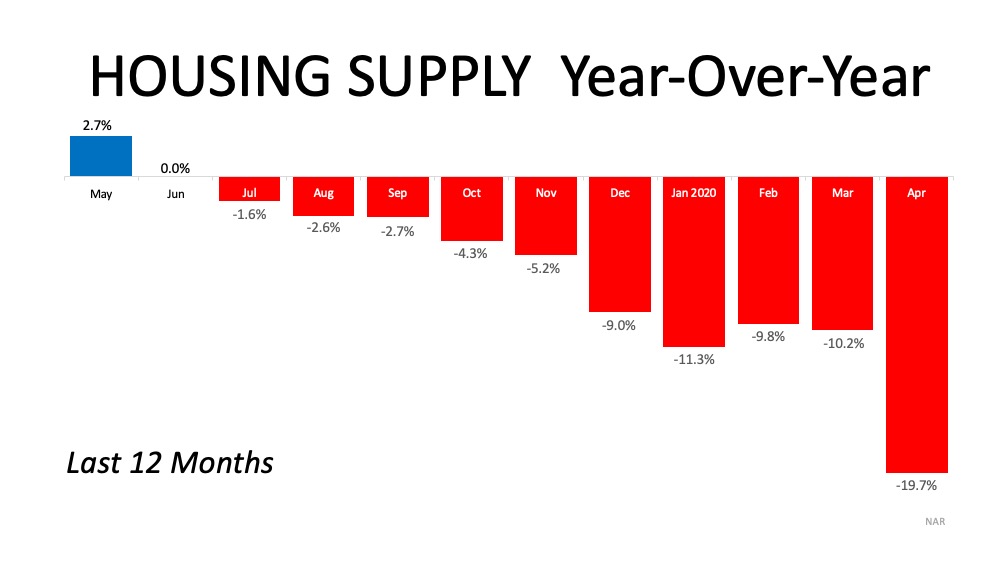

The inventory of overall homes for sale is well below the demand from potential buyers, so many eyes may be searching for a home like yours. According to the National Association of Realtors (NAR), total housing inventory, meaning homes available to purchase, is down 19.7% from one year ago (see graph below): Inventory across the country continues to be a challenge, with only a 4.1-month supply of listings available at the current sales pace. For a balanced market, where there are enough homes available for interested buyers to purchase, that number would need to bump up to a 6-month supply. This means we don’t have enough inventory for the number of buyers looking for homes, so selling in this scenario is ideal. Buyers are looking now, and some vacation homes make a great primary residence or second home for those eager to escape from more populated urban areas.

Inventory across the country continues to be a challenge, with only a 4.1-month supply of listings available at the current sales pace. For a balanced market, where there are enough homes available for interested buyers to purchase, that number would need to bump up to a 6-month supply. This means we don’t have enough inventory for the number of buyers looking for homes, so selling in this scenario is ideal. Buyers are looking now, and some vacation homes make a great primary residence or second home for those eager to escape from more populated urban areas.

2. Home Prices

The lack of inventory is also keeping homes from depreciating in value. Today, prices are holding strong and experts forecast home price appreciation to continue throughout this year. Selling your home while prices are holding steady is a sound business move. You’ll likely have equity you’ve earned working for you as well. If your home has been vacant for the past few months, the forced savings you have built in your equity may help balance out possible rental income loss due to the slowdown in the travel industry.

Bottom Line

We don’t know exactly when heightened summer travel will return or what it will look like when it does. If you’re considering selling your vacation home, let’s connect today to determine your options in the current market.

The Benefits of Homeownership May Reach Further Than You Think

More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens that provide shelter, stability, and protection for our families through the evolving health crisis. Today, 65.3% of Americans are able to call their homes their own, a rate that has risen to its highest point in 8 years.

June is National Homeownership Month, and it’s a great time to reflect on the benefits of owning your own home. Below are some highlights and quotes recently shared by the National Association of Realtors (NAR). From non-financial to financial, and even including how owning a home benefits your local economy, these items may give you reason to think homeownership stretches well beyond a sound dollars and cents investment alone.

Non-Financial Benefits

Owning a home brings families a sense of happiness, satisfaction, and pride.

- Pride of Ownership: It feels good to have a place that’s truly your own, especially since you can customize it to your liking. “The personal satisfaction and sense of accomplishment achieved through homeownership can enhance psychological health, happiness and well-being for homeowners and those around them.”

- Property Maintenance and Improvement: Your home is your stake in the community, and a way to give back by driving value into your neighborhood.

- Civic Participation: Homeownership creates stability, a sense of community, and increases civic engagement. It’s a way to add to the strength of your local area.

Financial Benefits

Buying a home is also an investment in your family’s financial future.

- Net Worth: Homeownership builds your family’s net worth. “The median family net worth for all homeowners ($231,400) increased by nearly 15% since 2013, while net worth ($5,000) actually declined by approximately 9% since 2013 for renter families.”

- Financial Security: Equity, appreciation, and predictable monthly housing expenses are huge financial benefits of homeownership. Homeownership is truly the best way to improve your long-term net worth.

Economic Benefits

Homeownership is even a local economic driver.

- Housing-Related Spending: An economic force throughout our nation, housing-related expenses accounted for more than one-sixth of the country’s economic activity over the past three decades.

- GDP Growth: Homeownership also helps drive GDP growth as the country aims to make an economic rebound. “Every 10% increase in total housing market wealth would translate to approximately $147 billion in additional consumer spending, or 0.8% of GDP, as well as billions of dollars in new federal tax revenue.”

- Entrepreneurship: Homeownership is even a form of forced savings that provides entrepreneurial opportunities as well. “Owning a home enables new entrepreneurs to obtain access to credit to start or expand a business and generate new jobs by using their home as collateral for small business loans.”

Bottom Line

The benefits of homeownership are vast and go well beyond the surface level. Homeownership is truly a way to build financial freedom, find greater satisfaction and happiness, and make a substantial impact on your local economy. If owning a home is part of your dream, let’s connect today so you can begin the homebuying process.