|

|||||||||||||||||||||||||||||||||||

Hosted by Tony and Wendi Meier of Windermere Real Estate/NE

|

|||||||||||||||||||||||||||||||||||

KIRKLAND, Washington (November 5, 2015) – With holidays approaching, real estate brokers usually expect a slowdown as buyers and sellers shift their attention elsewhere. “This year is different,” say some industry leaders.

“Today we have one of the best markets we’ve ever seen for sellers,” observed Ken Anderson, managing broker and owner at Coldwell Banker Evergreen in Olympia. “Buyers are still surging to the market and inventory is low. It’s a very good time to sell. Owners who are eager to make the next move don’t have to wait six months or until spring to act,” added Anderson, a former board member at Northwest Multiple Listing Service.

Newly released MLS figures for October show pending sales are up 7.8 percent from a year ago, rising from 8,643 transactions to 9,317. Nearly half the counties in its service area reported double-digit gains in the number of mutually accepted offers. For the four-county Puget Sound region encompassing King, Kitsap, Pierce and Snohomish counties, Northwest MLS members tallied 6,977 pending sales, the highest October volume in a decade.

For 19 of the 23 counties in the latest MLS report the number of pending sales surpassed the number of new listings added to inventory. System-wide there were 8,094 new listings that came on the market during October, about the same as 12 months ago when members added 8,102 listings. With those additions (the fewest monthly total since February) inventory at the end of the month stood at 18,068 listings, well below the year-ago total of 23,501 for a 23.1 percent year-over-year drop.

Closed sales rose 7 percent from a year ago, increasing from 7,257 to 7,769. Last month’s total slipped below 8,000 closings for the first time since April, with some brokers citing inadequate inventory as a factor.

“Given the severe shortage of homes for sale, I’m not surprised to see that both pending and closed sales slowed down last month,” said OB Jacobi, president of Windermere Real Estate.

Broker Mike Gain agreed. “If we just had more homes to sell the number of closed units would have increased even more during October,” he stated. “Selling more homes at a faster rate than we are replenishing supply shows just how good the local real estate market really is,” remarked Gain, CEO and president of Berkshire Hathaway HomeServices Northwest Real Estate.

The MLS reported 2.33 months of supply area-wide, well below the 4-to-6 months figure many in the industry say indicates a balanced market. The months of supply figure has not been above three months since February when the figure was 3.56.

Both King and Snohomish counties had less than two months of supply. The most acute shortages are in King County with only 1.29 months of supply; Snohomish has 1.91 months of supply.

Commenting on the gap between supply and demand, MLS director George Moorhead said, “This is not sustainable and will create a market condition where buyers will overpay for a home.” Moorhead, the designated broker at Bentley Properties, also commented on bidding wars. “Multiple offers are now being seen in outlying areas as buyers look farther out just to find a home that is a perfect fit while sacrificing distance to work and services.” Good schools remain the highest sought-after criteria, he added.

Even with inventory shortages in some areas, strong open house traffic is expected for the coming weekend, thanks to the bye on the Seattle Seahawks schedule, suggested MLS director Frank Wilson. “A weekend without a Hawks game is good news for real estate brokers and sellers who hold open houses on Sundays, commented Wilson, the branch managing broker at John L. Scott, Inc. in Poulsbo.

Open houses for new listings draw decent traffic, Wilson reported, adding. “New listings get picked through pretty quickly, and homes that are correctly priced are selling within days, with multiple offers.” He also said homes that have been on the market for more than 60 days have little traffic unless they have had a price reduction. “Some sellers are tending to overprice their homes due to all the hype.”

Gain noted the Seattle area’s home price gains are outpacing the nation’s, earning the city No. 1 ranking on a recently released list of the hottest single-family housing markets in the U.S. He credits strong demand, rising prices, low interest rates and the area’s healthy economic conditions as reasons for the strength.

“We will experience a hot housing market over the winter months,” predicts J. Lennox Scott, chairman and CEO of John L. Scott, who also expects 2016 to be “another fantastic year for sales activity.” Noting home sales activity is historically lower during this time of year, Scott believes activity this winter will be “red hot” in price ranges where inventory is low. He believes continued low interest rates and job growth will ratchet up demand as spring approaches.

Despite general optimism among Northwest MLS leaders, some pullback is anticipated.

Jacobi, who last month commented on the market being on the cusp of a slowdown, faults scarce inventory. “I expect this trend (of slower pending and closed sales) will likely continue through the end of the year due to the lack of available inventory for buyers.” Jacobi also said appreciation may start to slow over the winter months, adding, “but overall the housing market continues to benefit from our thriving local economy.”

Diedre Haines, principal managing broker-South Snohomish County for Coldwell Banker Bain, said they are noticing some slowdown, but “not as much as we’ve seen historically.”

“There remains a lot of frustration with multiple offers and getting transactions to actually make it to closing,” reported Haines, a past chairman of the Northwest MLS board. She attributes failed sales to several factors including low appraisals, financing issues, and an increase in sellers and buyers not being able to come to terms on inspections.

Prices on last month’s closed sales jumped nearly 9.7 percent from a year ago. Area-wide the median price for sales of single family homes and condos that closed during October was $318,000. That compares to a price of $290,000 for the same month a year ago.

For single family homes (excluding condos), year-over-year prices increased nearly 8.4 percent, rising from $299,950 to $325,000. In King County, the median price for a single family home was $480,000, rising 7.3 percent from the year-ago figure of $447,250, but dropping from September’s median price of $490,250.

“Appreciation for most of Snohomish County has continued, but not exorbitantly,” noted Haines. Prices in that county are up more than 5.8 percent from a year ago. “Modest gains in value are in reality much better for the market than the rapid gains we’ve seen in the past. For us, this means no sign of a growing bubble.”

The MLS reported strong sales in the condo segment, with both the volume and prices rising by double digits. Area-wide, closed sales rose 13.2 percent, from 990 units to 1,121. Prices surged 16.2 percent, jumping from $228,500 a year ago to last month’s median price of $265,500.

Condo inventory is also depleted with the number of active listings down nearly 26 percent from a year ago. MLS figures show only about 1.6 months of inventory area-wide; in King County there is less than 1.2 months of supply.

Looking ahead, Gain and many of his colleagues expect the area’s housing market will continue on a “gradual upward trend” into 2016. “As rents continue to rise, it makes buying a home more affordable than renting in many cases. It also insures that the monthly payment will remain the same as rents continue to escalate,” he stated, adding “Buying a home today is simply a smart decision for most who have the ability and resources to do so.”

Wilson said low inventory in areas like Kitsap County where his office is based will pose challenges. Inventory in that county is down nearly 30 percent from a year ago, while prices climbed more than 5.7 percent. “Some buyers are feeling beat up having to put in multiple offers or offer more than they are comfortable with,” he reported. Nevertheless, “buyers realize as we move into 2016 both prices and interest rates are likely to move upward,” he noted, adding, “We are anticipating a difficult spring market. The numbers are lining up for double-digit price increases in the first half of 2016.”

Northwest Multiple Listing Service, owned by its member real estate firms, is the largest full-service MLS in the Northwest. Its membership includes more than 23,000 real estate brokers. The organization, based in Kirkland, Wash., currently serves 23 counties in Washington state.

The residential housing market has been hot. Home sales have bounced back solidly and are now at their second highest pace since February 2007. Demand remains strong going into the winter. Many real estate professionals are reporting that multiple offers are occurring regularly and listings are actually selling above listing price. What about your house?

If your home is on the market and you are not receiving any offers, look at your price. Pricing your home just 10% above market value dramatically cuts the number of prospective buyers that will even see your house. (See Chart)

The housing market is hot. If you are not seeing results you want, sit down with your agent and revisit the pricing conversation.

Within the next five years, Baby Boomers are projected to have the largest household growth of any other generation during that same time period, according to the Joint Center for Housing Studies of Harvard. Let’s take a look at why…

In a recent Merrill Lynch study, “Home in Retirement: More Freedom, New Choices” they surveyed nearly 6,000 adults ages 21 and older about housing.

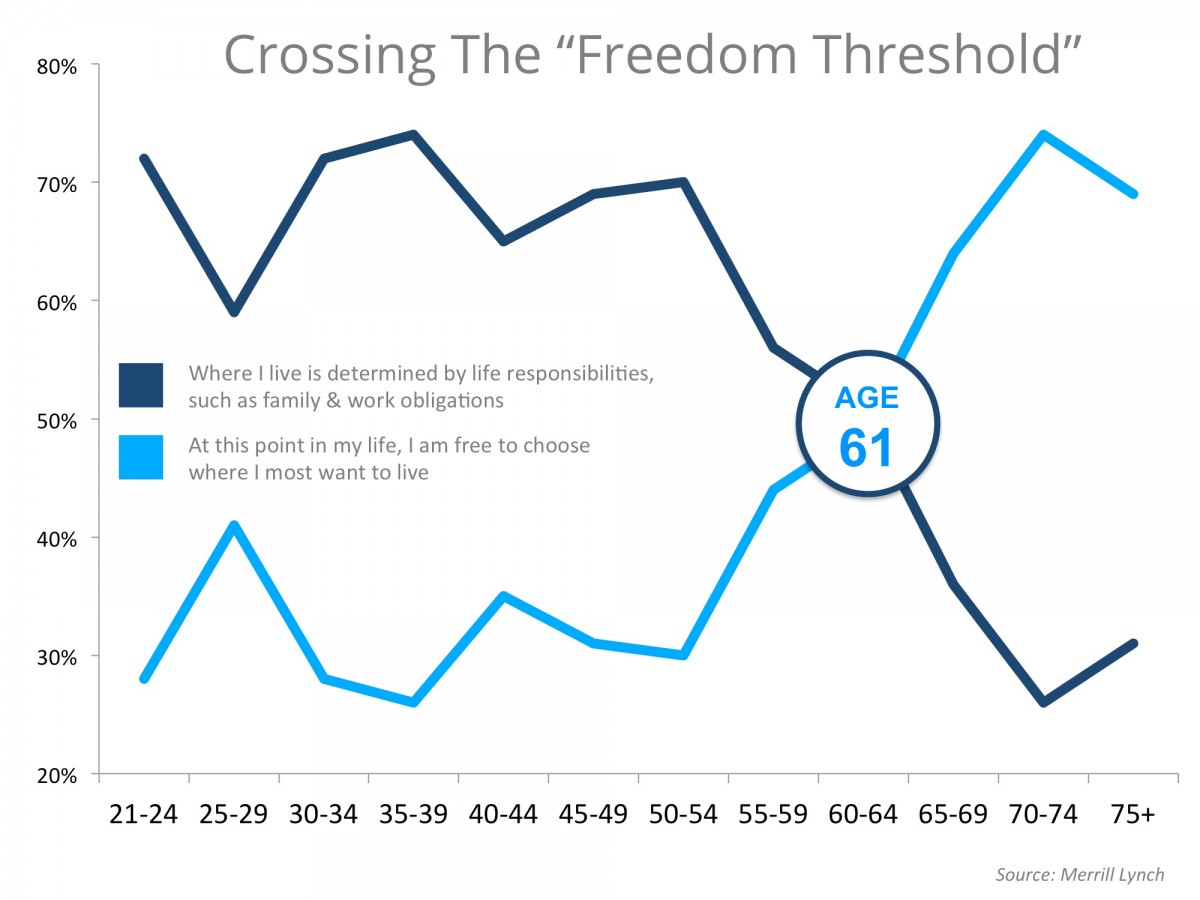

Throughout our lives, there are often responsibilities that dictate where we live. Whether being in the best school district for our children, being close to our jobs, or some other factor is preventing a move, the study found that there is a substantial shift that takes place at age 61.

The study refers to this change as “Crossing the Freedom Threshold”. When where you live is no longer determined by responsibilities, but rather a freedom to live wherever you like. (see the chart below)

As one participant in the study stated:

As one participant in the study stated:

“In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve had that kind of freedom.”

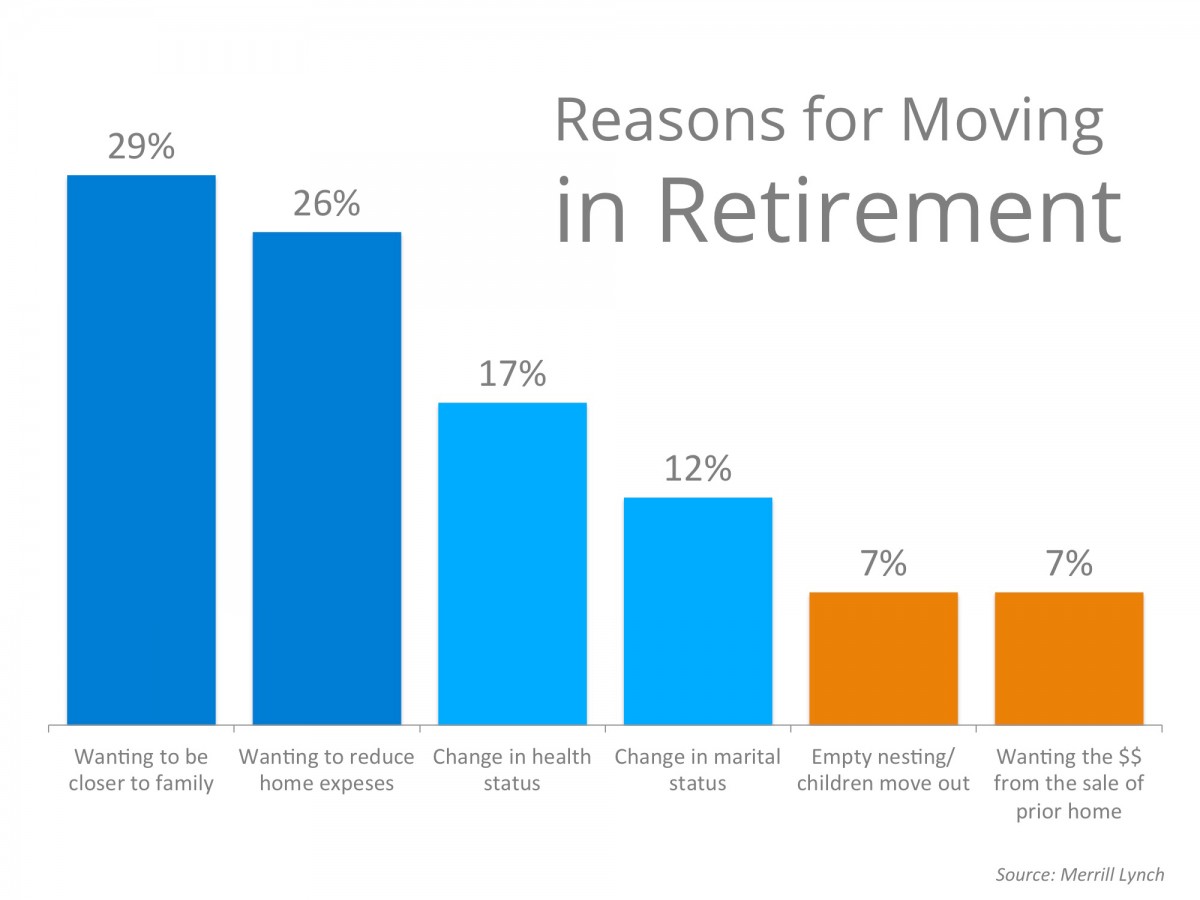

According to the study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement.

The top reason to relocate cited was “wanting to be closer to family” at 29%, a close second was“wanting to reduce home expenses”. See the chart below for the top 6 reasons broken down.

Not Every Baby Boomer Downsizes

Not Every Baby Boomer Downsizes

There is a common misconception that as retirees find themselves with fewer children at home, they will instantly desire a smaller home to maintain. While that may be the case for half of those surveyed, the study found that three in ten decide to actually upsize to a larger home.

Some choose to buy a home in a desirable destination with extra space for large family vacations, reunions, extended visits, or to allow other family members to move in with them.

“Retirees often find their homes become places for family to come together and reconnect, particularly during holidays or summer vacations.”

If your housing needs have changed or are about to change, let’s get together and discuss your next steps.

There have been some who have voiced doubt as to whether or not the younger generations still consider buying a home as being part of the “American Dream”. A study by Merrill Lynch puts that doubt to rest.

According to their research, every living generation still maintains that owning a home is in fact important. Here are the numbers:

This should not surprise us as many studies have revealed the benefits enjoyed by the families who own their own home. One such study was done by the Joint Center of Housing Studies at Harvard University that addressed a major financial benefit to owning your own home: forced savings. The report explains:

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

The Merrill Lynch study proves this point with the following data on home equity (a form of savings):

There are many reasons that owning a home makes sense. The financial reasons are powerful. As one participant in the Merrill Lynch study put it:

“When I was younger, I always worried about that monthly mortgage payment. Now that I am retired, I have the peace of mind of knowing I own my home free and clear.”